Lending Crowd, a peer-to-peer lending platform, has announced its closure and will no longer accept new loan applications starting November 15.

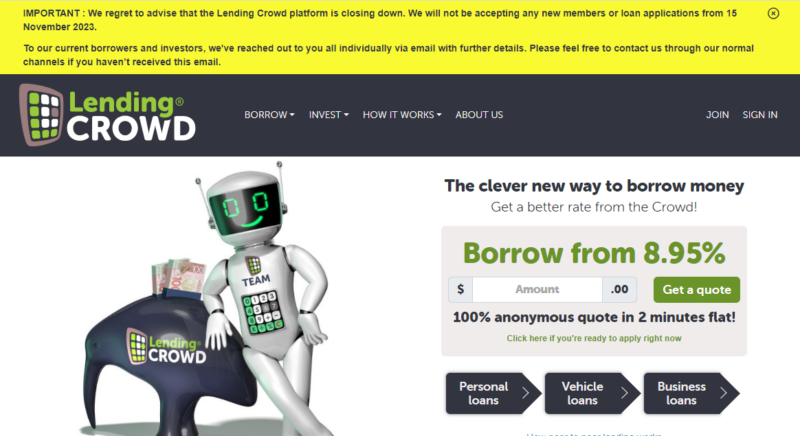

A note on their website reads:

IMPORTANT : We regret to advise that the Lending Crowd platform is closing down. We will not be accepting any new members or loan applications from 15 November 2023.

To our current borrowers and investors, we’ve reached out to you all individually via email with further details. Please feel free to contact us through our normal channels if you haven’t received this email.

The platform connected borrowers with investors, offering unsecured rates between 9.25% and 24.6% based on loan risks.

Peer-to-peer lending emerged in New Zealand in 2014 as a potential disruptor in the finance sector, but some companies have struggled to gain traction and establish sustainable operations.

One notable example is Harmoney, which shut down its peer-to-peer platform in 2020 and shifted to funding loans from wholesale markets.

Data from the Financial Markets Authority reveals that the number of outstanding peer-to-peer loans decreased by 8.58% in the year leading up to June 2022, with slightly over 20,000 loans remaining.

Banking expert John Kensington from KPMG notes that there could be several factors contributing to the challenges faced by peer-to-peer lending platforms in general, although he did not specifically examine Lending Crowd.

Firstly, these platforms may encounter problems in distribution as they primarily rely on websites and automation, potentially lacking the personal touch that banks with physical branches and staff offer.

This could limit their ability to present their products effectively to potential customers.

Additionally, during difficult economic periods, individuals may be more inclined to stick with familiar and reputed options for investing their money, such as banks.

Banks and finance companies have also started to increase their rates, reducing the attractiveness of seeking better rates through alternative platforms like peer-to-peer lenders.

Furthermore, the slowdown in other sectors, such as the buy now pay later industry, could reflect broader challenges present in the economy.

New financial products and services often experience an initial growth spurt before facing the reality of well-established competitors already holding significant market share.

Overcoming this hurdle can be difficult, as many consumers may not be sufficiently motivated to switch to alternative options.