This article was first published in 2015.

Last month I wrote about how we live on a fixed budget.

In that post, I mentioned that we lived in a starter home. I really should punch myself in the face for typing those words into my blog because I hate the term ‘starter home’.

Let me tell you why

I’m pretty sure the term ‘Starter Home’ was coined by the real estate industry, which wanted to ensure you know your place on the property ‘ladder’.

In case you don’t, it’s at the bottom. You live in a starter home. That’s the first rung. Just above the dirt.

The Kiwi/Australian/American/British/Irish dream (I can honestly say that after travelling to all of these countries we are all fed the same bullshit dream) tells us that we should buy our first house, renovate it and then in a few years sell and use the equity gain to trade up.

To a middle-class McMansion. With a McMansion mortgage to match (oh – the alliteration).

This ‘dream’ assumes you will work in your career until you make it to the top. With your healthy salary, paying off your mortgage over 30 years is manageable.

Hopefully, you won’t die of a heart attack at 48.

So Emma, what’s wrong with this attractive-sounding dream?

Nothing. If it’s truly your dream.

Not one you were fed by some real estate agent or family member.

If it’s not your dream to continue upping your mortgage payments until you die, keep reading.

What exactly is a starter house/home?

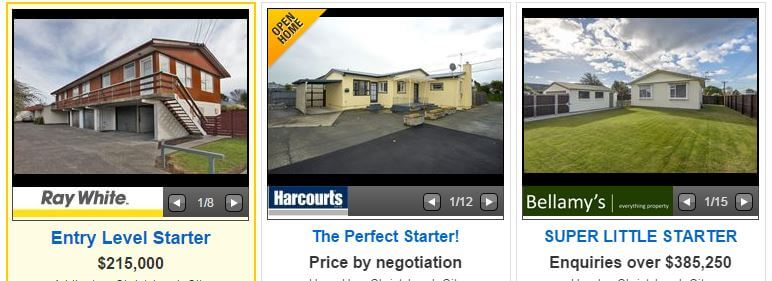

Starter homes are typically in lower socioeconomic areas and, therefore, have a lower price tag.

In New Zealand, they are likely to be older homes needing renovation work.

They are almost always livable from the outset but you probably won’t be hosting dinner parties for a while.

Talking only about the real estate markets with which I am familiar, starter homes tend to be either ex-rental properties or someone else’s first home.

They may be in areas where a large percentage of people rent.

Our starter house is 120sqm (1290sqft), consisting of three bedrooms, one bathroom, and two toilets.

It is painted the vilest peach colour I have ever seen.

It is less than 4km from the city centre and within walking distance of two schools.

We paid $225,000 in 2011. It’s currently worth around $325,000 (or it will be after earthquake repairs are completed).

Before we purchased it, it was a family home that had been used as a rental for ten years.

Here’s what’s wrong with the McMansion dream.

A house is not an investment (unless you purchase rental property), it does not produce income. Pouring all your money into it is just stupid.

The smart thing to do is take care of your housing expenses as early as possible by finding the cheapest way to live that you can tolerate—buying a starter house is the simplest way to do this.

Then, you can use your employment income to build a portfolio of income-generating assets like stocks (shares), bonds, term deposits, rental property, or whatever you like.

(If all that sounds like gibberish to you, I suggest reading The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life – it’s my fave personal finance book for newbies.)

Why is a starter home a great place to build wealth?

- Starter homes are usually in low to mid-socioeconomic areas and come with a lower price tag to match.

- The mortgage payments are affordable. Lower loan balances mean lower repayments. If you decide you don’t want to go back to work right after having kids, the mortgage on your starter house is manageable on a lower-income. Also excellent if a frugal life is your goal.

- You don’t have to keep up with the Joneses. Everyone else will be mowing their own lawns, doing their own repairs and DIY jobs.

- Usually in high rental areas. This means if you want to take a year off and travel, it’s likely there will be a big market of potential tenants.

- Resale. If you need to sell you’ll likely have a bigger pool of buyers – both investors and first home buyers. Since you bought a starter home the price appeals to a larger group.

- You can pay it off faster, freeing up money to build real wealth with income-producing investments.

- You can alter it to suit your requirements when you have the cash.

- Staying in the one house eliminates all the costs of buying and selling. In New Zealand, that means legal costs, bank financing costs, engineers and surveyors reports, real estate agent commissions, and the cost of staging your property for sale – this list goes on.

- If you buy in an area with good prospects and stick around for life, you’ll likely see gentrification happening and make a nice capital gain on your property value if you decide to downsize when you are older. Even if the value of your property only keeps pace with inflation, you’ll still do well over the long term. Meaning that if you, like me, want to retire in Mexico, you’ll have a nice stash of cash to take with you.

- No weird covenants – like this housing estate/subdivision in New Zealand that dictates what kind of letterbox you have.

Buying an affordable house and paying down the mortgage before you reach retirement age should be the minimum financial investment you make.

At the very least you’ll have a stable home for your retirement years, even if you rely on NZ Super for living costs.

And you won’t have to deal with roommates in your old age like in this funny but terrifying Kiwi ad.

Renting for life is risky; anyone planning to rent for life better have a smart investment strategy behind them.

Look at NZ Super (our equivalent of social security/pension) – it’s enough to live on, currently at $576.20 weekly for a couple – but that’s assuming you have a mortgage-free home.

With the median rent in parts of Christchurch at $410 per week, renting in your old age would not only suck, it’d probably kill you.

My starter house is part of my retirement plan.

I intend to clear the mortgage within a decade (update: done) and then funnel those mortgage payments into retirement funds.

No doubt, I’ll be renovating and making alterations to the house as I go, but I’m betting that compared to closing costs and upping mortgage payments on a new property, I will end up much better off.

What do you think? Would you live in a starter house forever?