You might think frugal living is reusing your coffee filters or giving up avocado toast. But it doesn’t have to be that.

The frugal living tips below can help you save money without sacrificing your lifestyle.

Yup – that’s right! Living a frugal life can be whatever you want – whether that’s cutting back on luxuries like coffee and makeup or downgrading from streaming services to basic cable.

Frugal living can help you:

- hit your financial goals,

- attain financial freedom,

- reduce your impact on the planet.

In this guide, I share some ideas on how to incorporate more frugality into your life.

You don’t have to do it all, but hopefully, you’ll find some frugal tips here to help you save and achieve your money goals.

Table of Contents

- What is Frugal Living?

- 135 Best Frugal Living Tips to Spend Less

- Frugal Living Tips – Kitchen

- 1. Meal Plan

- 2. Meal Prep

- 3. Use Up Your Leftovers

- 4. Shop at the Farmer’s Market

- 5. Join a Grocery Co-op

- 6. Cook from Scratch

- 7. Double batch your cooking

- 8. Never waste a hot oven

- 9. Reduce your grocery bill with Ibotta

- 10. Bulk up meals with lentils.

- 11. Shop your pantry

- 12. Try store brand

- 13. Learn how to make good coffee at home

- 14. Keep your freezer full

- 15. Drink Water

- 16. Unplug Small Appliances

- 17. Brown Bag It

- 18. Don’t leave the refrigerator/freezer door open

- 19. Eat at home

- 20. Eat whole food

- 21. Don’t use the oven in the summer

- 22. Use a slow cooker

- 23. Use an Instant Pot

- 24. Fill up the dishwasher

- 25. Don’t use the heat dry setting on the dishwasher

- 26. Keep a well-stocked pantry & freezer

- 27. Avoid using disposable

- 28. Use cloth napkins

- 29. Stop using paper towels

- 30. Use less water when hand-washing dishes

- 31. Use up a product completely before opening another

- 32. Cook once eat twice

- 33. Buy generic foods

- 34. Make a grocery list

- 35. Shop Online

- 36. Eat more meatless meals

- 37. Grocery shop less frequently

- 38. Start a garden

- Frugal Living Tips – Bathroom

- 39. Take military showers

- 40. Don’t leave the water running

- 41. Use up toiletries

- 42. Dry your razor

- 43. Use basic products

- 44. Install a low-water toilet

- 45. Fix leaky faucets

- 46. Install low-flow showerheads

- 47. Turn down the water heater

- 48. Bathe only when necessary

- 49. Install a timer on the hot water heater

- 50. Use foaming hand soap

- 51. Use a bidet

- Frugal Living Tips – Laundry

- 52. Wash your clothes in cold water

- 53. Hang your clothes to dry on a clothesline

- 54. Wear clothing more than once before washing

- 55. Buy high-quality used clothes

- 56. Wash full loads of laundry

- 57. Keep the lint filter on your dryer clean

- 58. Insulate your hot water heater

- 59. Make your own laundry detergent

- 60. Buy generic laundry detergent

- 61. Use less detergent

- 62. Skip the fabric softener and dryer sheets

- 63. Don’t over-dry clothes

- Frugal Home

- 64. Downsizing your home

- 65. Decluttering your possessions

- 66. Use a thermostat Using a thermostat is a smart way to be efficient with your heating.

- 67. Buy used where possible

- 68. Switch to homemade cleaners

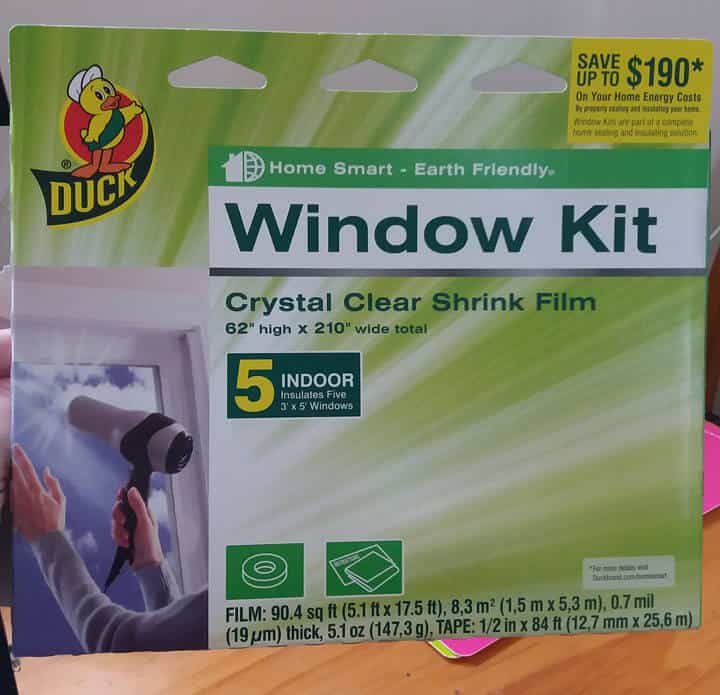

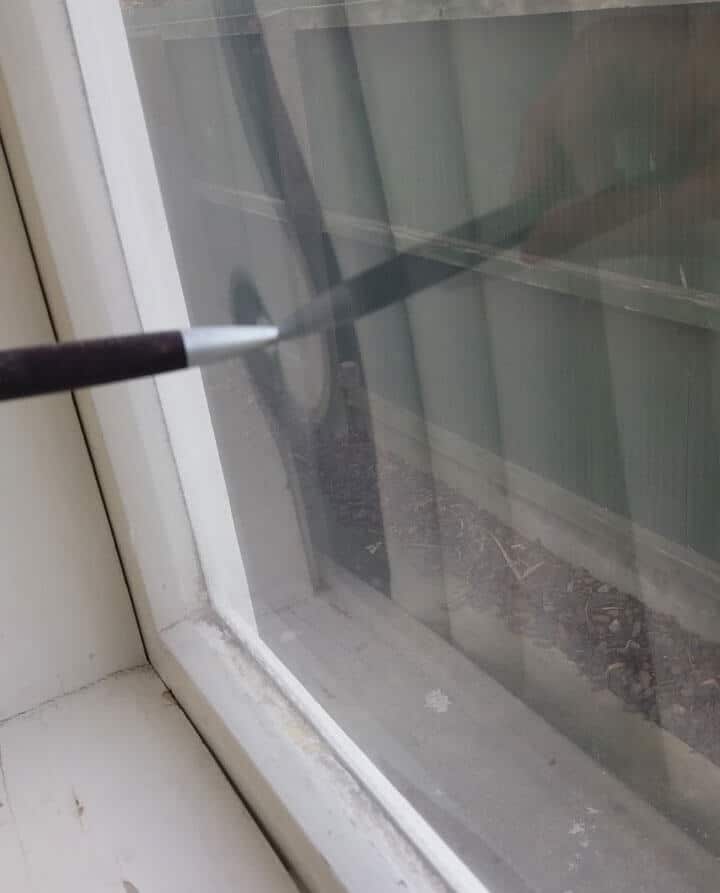

- 69. Replicate double pane windows on the cheap

- 70. Switch to LED bulbs

- 71. Unplug electronic devices

- 72. Keep lights and fans off

- 73. Use surge protectors

- 74. Close off rooms you don’t use

- 75. Set ceiling fans counter-clockwise during the summer

- 76. Sell your stuff

- 77. Open windows in the morning

- 78. Keep shades drawn

- 79. Keep shades open

- 80. Insulate your attic space

- 81. Weatherstrip

- 82. Use a space heater

- 83. Keep filters and ducts clean

- 84. Insulate exposed pipes

- 85. Eliminate cable

- 86. Ditch the landline

- Frugal Family

- Frugal Living Tips – Transport

- Frugal Living Tips – Entertainment

- Frugal Living Tips – Finances

- 109. Create a budget that works for your lifestyle

- 110. Pay off debt

- 111. Find ways to make extra money

- 112. Pay for gifts with gift cards

- 113. Set a frugal Christmas budget

- 114. Get cashback on everyday purchases

- 115. Save an emergency fund

- 116. Avoid debt where possible

- 117. Use a cash-back credit card

- 118. Never pay for banking

- 119. Return items you haven’t used

- 120. DIY where it makes sense

- 121. Try a no-spend month

- 122. Cancel subscriptions

- 123. Repair don’t replace

- 124. Look for free ways to exercise

- 125. Shop clearance racks

- 126. Ask for price matching

- 127. Pay your bills on time

- 128. Set up automated savings

- 129. Refinance loans

- 130. Quit smoking, drinking, and eating fast food

- 131. Maintain your stuff

- 132. Avoid impulse purchases

- 133. Check bills and credit card statements

- 134. Shop around for insurance

- 135. Cash in all your coins

- Frugal Lifestyle Tips – FAQS

What is Frugal Living?

Frugal living is simply being intentional with your money.

That means spending WISELY on the things that are important and reducing your spending on things that you don’t value.

A real-world example of this is in my pantry. I only buy store-brand staples. Cereal, pasta, flour, herbs and spices, canned tomatoes, toilet paper.

Saving a few dollars on pantry staples means I can save more for travel.

Top 3 Benefits of Frugal Living There are some other benefits of living frugally you might not be aware of yet.

There are some other benefits of living frugally you might not be aware of yet.

1. Frugal living gives you peace of mind

Frugal living is really important when it is hard to make ends meet.

If you’ve saved up an emergency fund in cash, and have low or no debt, then it is not so scary if you lose your job.

When times are tough, I am grateful that I have made a plan to get out of debt and save money. If you want to do the same, be frugal.

2. Frugal living is good for the environment

Buying used instead of new, eating at home instead of taking out and making do with what you have is better for the planet.

You will reduce the number of emissions from your car as well as get healthier if you decide to become a one-car family or commute by bike.

People who are frugal and consume less will be good for the planet.

3. Frugal living sets a good example for your kids

Frugality is good for you and your children. They will notice if you are careful with your money.

Raising frugal children is a good thing because it will help them to be successful and have more money.

You can read more benefits of frugal living here

Now – on to the best frugal living tips for achieving your dream life.

135 Best Frugal Living Tips to Spend Less

Frugal Living Tips – Kitchen

1. Meal Plan

Meal planning not only saves you money, but it can also save you time too.

I like to meal plan around what I already have in the freezer or cupboards. I then write my grocery shopping list to fill the gaps in the meal plan.

This stops me from buying things I don’t need – and don’t have room to store, and forces me to use up what we’ve got.

If you need help meal planning, the $5 Meal Plan is an awesome service that’ll send you out meal plans so you don’t have to do anything.

Meal planning is one of the best frugal tips because the grocery bill is usually one place most people can make savings.

2. Meal Prep

By prepping your meals in advance, you can make frugal and healthy choices without spending hours in the kitchen.

Meal prepping doesn’t have to be complicated: even something as simple as pre-chopping vegetables can save you time during the week.

So if you’re ready to make mealtime easier, give meal prep a try. You might just find that it’s a game-changer.

3. Use Up Your Leftovers

Using up your leftovers is a great way to save money on food.

If you have a bit of this and a bit of that, whip up a quick dish like fried rice, soup or a stir-fry.

4. Shop at the Farmer’s Market

Farmer’s markets are awesome because not only do you get fresh produce, but you can also buy the exact amounts you need which will reduce food waste.

And who doesn’t love a wander through a market on a sunny day?

5. Join a Grocery Co-op

Grocery co-ops are becoming more popular as you can buy in bulk which will save you money, and you can also get organic produce and local meat and dairy products.

6. Cook from Scratch

Cooking from scratch means you know exactly what is going into your dish, and you can usually make it for cheaper than if you bought it pre-made.

There are so many recipes online that are easy to follow.

7. Double batch your cooking

Living frugally 101 – never cook just one meal. I either use my crockpot to cook up a bulk lot of meals or prepare enough for 2 full family meals.

Turning on your cooker costs money – make it count!

8. Never waste a hot oven

Another of my top frugal living tips is never waste a hot oven!

If you’re cooking a roast dinner and the oven is at full temperature, prepare some baking (these muffins work great) to put in the oven as soon as you take out your main course.

They should cook in half the usual time.

9. Reduce your grocery bill with Ibotta

It’s easier to save a dollar than make a dollar. That’s why most frugal living blogs focus on ways to save money.

Joining Ibotta is one of the simplest ways to save money every day.

Ibotta is an app that allows you to earn money from scanning your receipts, claiming offers, and using coupons – read more here.

The best thing about Ibotta is that you can save money on the things you buy regularly – including fresh produce. Once you have over $20 in credit you can cash out with PayPal or gift cards.

10. Bulk up meals with lentils.

One of the best frugal tips I was told was to stretch out ground beef with red lentils.

Using red lentils to bulk up meals means I have been able to reduce the amount of ground beef I put into things like bolognese, casseroles and chili.

This saves me loads on meat, plus lentils are packed full of goodness.

11. Shop your pantry

Using up what you’ve already got on hand is the best way to prepare frugal meals.

Unfortunately for those of us who aren’t kitchen masters, being creative with new meal ideas doesn’t come naturally.

One of my top frugal lifestyle tips is to check out Supercook.

This site allows you to enter the ingredients you have on hand to come up with a frugal meal idea.

12. Try store brand

Every time you go to the grocery store substitute one brand item for the store brand.

This is a simple frugal living tip to figure out which cheaper brands you can live with.

13. Learn how to make good coffee at home

One of my biggest struggles when learning how to live more frugally was coffee. I love barista-made coffee. But at $5 a cup, my budget had other ideas.

If you like coffee, one of the most simple ways to spend less every day is to learn how to brew the perfect cup at home.

Buying a home espresso machine was the best thing I ever did for my budget. I instantly stopped spending $5/day on lattes. Now I prefer my own coffee.

Now that I’ve got my finances under control and know how to live a frugal life that’s right for me, I go out for coffee with friends and family whenever I want.

But I always have a sit-down coffee in a real cup to savor the experience and I still make my own at home most days.

You don’t need to spend a lot of money to get a decent espresso machine. The Mr Coffee Cafe Barista Espresso and Cappuccino Maker pictured above sells well and has excellent reviews.

However, you do it, learning how to make your fav coffee drinks at home will save you a bundle of cash.

14. Keep your freezer full

Keeping your freezer full saves money in two ways. Firstly, because you will be less likely to buy extra groceries when you have food on hand that you can cook.

Another benefit of keeping your freezer full is that you will use less energy, as the cold air will stay in the freezer longer.

Don’t worry if you can’t keep your freezer full of food. Filling old bottles 3/4 of the way with water will achieve the same outcome.

15. Drink Water

Drinking water is one of the simplest and easiest ways to save more money on a daily basis.

Not only does it help to keep you hydrated, but it also helps to reduce your overall spending on drinks.

One way to make sure you are drinking enough water is to purchase a reusable water bottle. This will help you to stay hydrated throughout the day, without having to spend money on bottles of water.

16. Unplug Small Appliances

Unplugging small appliances when they are not in use is a simple way to save money on your energy bill.

This is because when appliances are plugged in, even if they are turned off, they still use electricity.

By unplugging appliances when they are not in use, you can save yourself a lot of money on your energy bill.

17. Brown Bag It

One of the top frugal living tips is to brown bag it for lunch instead of eating out..

This not only saves you money, but it is also healthier for you as you can control the ingredients that go into your food.

If you are struggling to come up with ideas for lunches, there are plenty of recipes online that

18. Don’t leave the refrigerator/freezer door open

Every time the refrigerator door is opened, cold air escapes and the compressor needs to work harder to bring the temperature back down.

This increases your energy bill and can be costly over time.

If you need to get something out of the fridge, try to do it quickly so that the door doesn’t stay open for long.

One simple tip I practice is to say out loud the item I am grabbing before I open the door. It helps eliminate time spent fridge browsing.

19. Eat at home

Eating out is one of the easiest ways to spend more money than you intended.

Not only do you have to pay for the food itself, but you also have to pay for drinks, taxes and tips.

On the other hand, eating at home is a great way to save money and eat healthy.

When you eat at home, you are in control of the ingredients that go into your food. This means that you can avoid eating processed foods and unhealthy additives.

20. Eat whole food

When you eat whole food, you are eating food in its natural state.

This means that you are getting all of the nutrients that the food has to offer, without any additives or chemicals.

Eating whole food is one of the best great frugal living tips to save money, as you will be less likely to get sick.

When you are sick, you need to take time off work and see a doctor, which can be costly.

Eating whole food is also a great way to lose weight and improve your health.

21. Don’t use the oven in the summer

Using the oven in summer raises the temperature in your home and increases your energy bill.

Try avoiding using the oven during summer and see what it does to your energy bill.

There are many other ways to cook food that do not involve using heat, such as grilling or barbecuing outdoors.

22. Use a slow cooker

Slow cookers cook food slowly and at a low temperature.

This means that you can cook food using less energy, which saves you money on your energy bill.

Slow cookers are also a great way to cook food cheaply. You can buy cheaper cuts of meat, as they will be cooked slowly and will be tender and juicy.

Another great thing about slow cookers is that they make it easy to cook food in bulk.

23. Use an Instant Pot

An Instant Pot is a programmable pressure cooker that can be used to cook food quickly and at a low temperature.

According to MarginMakingMom.com “electric pressure cookers can save as much as 70% of energy compared with boiling, steaming, oven cooking, or slow cooking”

24. Fill up the dishwasher

Many people opt to just fill the dishwasher halfway as it saves time for them, but it can cost you.

Your dishwasher will use the same amount of water and detergent regardless of whether you run a full load or half.

For this reason, it’s best to wait until the dishwasher is full.

25. Don’t use the heat dry setting on the dishwasher

Instead of using the heat dry setting, try air-drying or using a towel to dry your dishes.

This will reduce your energy bill and it’s better for the environment.

26. Keep a well-stocked pantry & freezer

When you have a well-stocked pantry, you will be able to cook food cheaply and quickly.

This is because you will have all of the ingredients that you need to make meals at home.

A smart money-saving idea is to buy an extra can of vegetables or legumes each time you go to the grocery store.

27. Avoid using disposable

While it’s convenient to grab a paper towel or a plastic fork when you’re on the go, these items often end up in landfills, where they take years to break down.

If you’re trying to reduce your environmental footprint, avoid using disposable products whenever possible. Instead, opt for reusable items like cloth napkins or stainless steel straws.

28. Use cloth napkins

One way to be frugal is to use cloth napkins. Cloth napkins can be used multiple times before they need to be washed.

Another benefit of using cloth napkins is that they are better for the environment.

Paper napkins are made from trees. When you use cloth napkins, you are not contributing to the deforestation of the planet.

29. Stop using paper towels

One frugal tip that can help you save money is to stop using paper towels. Paper towels are one of the most unnecessary single-use items, and they can quickly add up.

If you’re used to grabbing a paper towel to wipe up spills or wash your hands, try switching to a cloth towel instead.

You can use old t-shirts or dish towels that you would otherwise throw away. Just make sure to wash them regularly.

30. Use less water when hand-washing dishes

It may not seem like it, but the water we use while hand-washing dishes can add up over time.

But there are easy ways to be more frugal with this precious resource. For instance, when rinsing dishes, don’t let the water run the entire time.

Fill up a basin with soapy water and rinse everything off at once.

You can also save water by using a dishrag or sponge rather than running the tap while you scrub.

31. Use up a product completely before opening another

A top frugal living tip is to use up everything you have before buying more.

That way, you waste less and save money. But what’s the best way to go about using up products?

First, take inventory of what you have on hand. Make a list of all the unopened items in your pantry, fridge, and bathroom, as well as anything that’s halfway used.

Once you know what you have, start working your way through the list.

Use items that are close to their expiration date first, and then move on to those that will last longer.

If there’s something you’re not sure how to use up, do a quick search online for recipes or ideas.

32. Cook once eat twice

If you’re looking for frugal living ideas, cooking once and eating twice is a great place to start.

This simple technique can help you save time and money, while still eating healthy and delicious meals.

The key is to cook extra servings of your favorite dishes, then refrigerate or freeze the leftovers for later.

When you’re short on time, simply reheat the leftovers and enjoy.

With a little planning, cooking once can provide you with multiple meals that are both frugal and delicious.

33. Buy generic foods

Generic brands are often less expensive than name-brand products, and they can be just as good in terms of quality and taste.

Many store-brand products are made in the same factories as the name-brand versions.

34. Make a grocery list

Frugal living is all about making the most of your resources, and that includes your food budget.

One of the best ways to be frugal is to plan your meals in advance and make a grocery list.

That way, you can buy only what you need and avoid overspending.

When making your list, be sure to check your pantry, fridge, and freezer to see what you already have on hand.

35. Shop Online

My favorite frugal living tip is to shop online. Shopping online can be a great way to save on groceries.

By shopping online, you can compare prices and find the best money-saving deals. Plus you can easily add and remove items from your cart to ensure you stick to your budget.

And with grocery delivery services, you don’t even have to leave your house to get your groceries.

36. Eat more meatless meals

Meatless meals often require less cooking time and effort, which means you can save money on your energy bill.

In addition, meatless meals tend to be lower in calories and fat, which can help you maintain a healthy weight.

And because they’re usually made with fresh vegetables and whole grains, meatless meals are also packed with nutrients that are essential for good health.

So if you’re looking for a way to improve your health and be frugal, eating more meatless meals is a great place to start.

37. Grocery shop less frequently

Instead of making a trip to the store every week, try to stretch it out to every two weeks, or even once a month if possible.

This can be tough at first, but there are a few ways to make it work. First, take inventory of what you have on hand before heading to the store.

This will help you avoid buying things you already have. Second, make a list of the items you need and stick to it.

38. Start a garden

Growing your own fruits and vegetables is a great way to save at the grocery store.

Whether you have a large backyard or a small balcony, there are plenty of ways to get started. containers or raised beds are ideal for those with limited space.

It’s important to choose plants that will do well in your climate and that you’ll actually eat.

Frugal Living Tips – Bathroom

39. Take military showers

One of the best ways to conserve water is to take military showers.

This involves turning the water on to wet your body, then turning it off while you lather up, and then turning it back on again to rinse off.

By doing this, you can save a significant amount of water compared to taking a traditional shower.

40. Don’t leave the water running

One way to be frugal with water is to not leave the water running unnecessarily.

For example, when brushing your teeth, turn the faucet off while you are scrubbing and only turn it back on to rinse.

The same goes for washing your hands; turn the faucet off while you are lathering up and only turn it back on when you are ready to rinse.

41. Use up toiletries

Most of us have at least a few half-used products taking up space in our bathroom cabinets.

Whether it’s that bottle of shampoo that you never liked or the box of facial tissues that you misplaced, we’ve all got at least a few items that we’re not using.

42. Dry your razor

When you leave your razor damp, the metal is more susceptible to rusting and the blades can dull more quickly.

To keep your razor in top condition, be sure to dry it thoroughly after each use.

43. Use basic products

There’s no need to spend a lot of money on fancy bathroom products.

Some of the most effective cleaning products are ones that you probably already have in your home.

For example, a frugal way to clean your toilet is to use a mix of baking soda and vinegar.

Just pour a cup of baking soda into the bowl and then add a few tablespoons of vinegar. Let the mixture sit for a few minutes, then brush and flush.

This DIY toilet cleaner will leave your toilet sparkling clean without any harsh chemicals.

44. Install a low-water toilet

Low-water toilets are becoming increasingly popular as frugal homeowners look for ways to reduce their water usage.

Low-water toilets typically use between 1 and 2 gallons of water per flush, compared to the standard 3 to 5 gallons.

45. Fix leaky faucets

A dripping faucet can waste a lot of water.

Fortunately, repairing a leaky faucet is usually a simple task.

In most cases, the problem is simply a worn-out washer. By replacing the washer, you can stop the drip and save yourself a lot of money and water.

46. Install low-flow showerheads

Low-flow showerheads use less water than traditional showerheads, without sacrificing water pressure or quality.

As a result, they can help save on your water bill every month.

47. Turn down the water heater

Most water heaters are set to around 140 degrees Fahrenheit, but you can usually save energy by turning it down to 120 degrees.

In addition, lowering the temperature of your water heater can help to prevent scalding accidents.

So if you’re looking for a quick and easy way to save money, turning down your water heater is a great place to start.

48. Bathe only when necessary

Unless you’re particularly dirty or sweaty, you don’t need to take a shower every day.

Bathing too often can strip away natural oils and lead to dry, irritated skin. If you do decide to take a shower, make it a quick one.

49. Install a timer on the hot water heater

Installing a timer on your hot water heater can help you reduce on your energy bill by ensuring that your hot water heater only runs when you need it.

For example, you can set the timer to turn off during the hours when you are asleep or at work.

The timer can be programmed to turn on a few minutes before you wake up or arrive home so that you always have hot water when you need it.

50. Use foaming hand soap

While there are many different types of soap available, foaming hand soap is a great option for frugal homeowners.

Not only does it create a rich lather, but it also uses less soap per wash.

51. Use a bidet

Not only will it save you money on toilet paper, but it can also help you to stay clean and healthy.

Using a bidet is simple – just position yourself over the stream of water and let it do its work.

And because they use far less water than a toilet, they’re also more environmentally friendly.

Frugal Living Tips – Laundry

52. Wash your clothes in cold water

Washing your clothes in cold water makes your clothes last longer (source). This is because cold water preserves the dyes and does not shrink your clothes.

I run almost all my laundry through a cold cycle only. For everyday washing, a cold cycle should be just fine. Try it and see what you think.

53. Hang your clothes to dry on a clothesline

Line drying is another great frugal tip. Line drying will save you money on electricity and dryer sheets – plus not having a dryer can save you space if you only have a small laundry as we do.

We have a clothesline in the backyard for when the weather is good, and an over-the-door drying rack for when we need to dry things inside.

54. Wear clothing more than once before washing

Instead of washing your clothes after every wear, try to wait a few days in between washes.

This will reduce your water bill and prolong the life of your clothes.

Of course, this doesn’t mean that you should go weeks without washing your clothes! If an item is soiled or smells bad, it’s time to break out the detergent.

But for most everyday items, you can easily get a few more uses out of them before they need to be washed.

55. Buy high-quality used clothes

There are lots of frugal living tips out there, but one of the best is to buy high-quality used clothes.

Not only do you save money by doing this, but you also end up with better-made garments that will last longer.

Look for gently-worn items at consignment shops, thrift stores, and online resale sites.

You can often find designer labels and name brands for a fraction of the retail price.

And since these items have already been worn and washed, you’ll know they’re comfortable and durable.

56. Wash full loads of laundry

Are you doing your laundry frugally? Washing fewer, larger loads of laundry is one of the best ways to save water, energy and money.

It cuts down on the number of times you have to run your washing machine and dryer, and it significantly reduces the amount of water and electricity used. Honestly, it’s a no-brainer!

57. Keep the lint filter on your dryer clean

A clean lint filter is one of the simplest and most effective ways to save money on your utility bills.

A build-up of lint can cause your dryer to work harder, resulting in higher energy costs.

In addition, a clogged filter can lead to overheating, which can damage your clothes and shorten the life of your dryer.

To keep your filter clean, simply remove it after each load of laundry and brush off any lint that has accumulated.

You may also need to vacuum the filter periodically to remove any built-up dust.

58. Insulate your hot water heater

By insulating your hot water heater, you’ll be able to maintain water temperature more easily, which means your heater won’t have to work as hard – and use as much energy – to keep the water hot.

You can purchase a hot water heater blanket for relatively cheap, and installing it is a quick and easy task that most people can do themselves.

In addition, insulating your hot water heater will help to prevent pipes from freezing in the winter.

59. Make your own laundry detergent

Making your own laundry detergent is a great way to save money and extend the life of your clothes.

Store-bought detergents can be expensive, and they often contain harsh chemicals that can damage the fabric.

You can easily make your own laundry detergent at home with just a few simple ingredients.

The most important ingredient is soap, which will help to lift dirt and stains from fabric.

You can use any type of soap, but castile soap or fels-naphtha soap are the best choices for laundry detergent.

In addition, you will need Borax or washing soda to act as a water softener and promote cleaning. Finally, add some essential oils for a pleasant scent.

60. Buy generic laundry detergent

Generic brands often cost less than half of what name brands charge, and they typically perform just as well in terms of cleaning power.

In addition, generic brands are often more frugal in their use of packaging and resources. .

61. Use less detergent

If switching to generic brands or making your own is out of the question, you can simply use less of your favorite brand name detergent.

Many people assume that they need to use a lot of detergent in order to get their clothes clean. However, this is not the case.

In fact, using too much detergent can actually cause problems, such as leaving behind a residue that can trap dirt and make your clothes appear dull.

It can also be hard on your washing machine, leading to costly repairs down the road. So how much should you use?

A good rule of thumb is to use about half the amount recommended on the bottle. You may need to experiment a bit to find the right amount for your laundry.

62. Skip the fabric softener and dryer sheets

If you’re looking for a frugal way to save money and extend the life of your clothes, skip the fabric softener and dryer sheets.

While fabric softener may make your clothes feel softer, it can actually damage the fibers and reduce their lifespan.

In addition, fabric softener can be costly, and it isn’t necessary if you’re using a quality laundry detergent.

Dryer sheets are also unnecessary, and they can leave a film on your clothes that attract lint. If you need to freshen up your laundry, add a few drops of essential oil to a towel and toss it in the dryer with your clothes.

63. Don’t over-dry clothes

Most of us have been there before. You put your clothes in the dryer, only to find that they’re still damp when the cycle is finished.

So you put them back in for another round, and then another.

Before you know it, you’ve wasted valuable time and money on drying your clothes longer than necessary.

Not only is this frustrating, but it can also damage your clothes.

Over-drying your clothes can cause them to shrink, fade, and become brittle. So how can you avoid this frugal mistake?

The key is to take them out of the dryer while they’re still slightly damp and hang them on a hangar right away. This may seem counterintuitive, but it will actually save you time in the long run.

Frugal Home

64. Downsizing your home

If you live in a too-large-for-you home, it could be costing you money that you don’t need to spend.

This was certainly the case for my family when we decided to downsize to a smaller home so we could save money (over $500/month).

Related: What Is the Cheapest Way to Live? 15 Low-Cost Housing Alternatives

65. Decluttering your possessions

Decluttering your possessions is a wonderful exercise in frugality and one that can actually save you money.

By getting rid of items you no longer use or need, you’ll have more space for the things that are important in your life.

You might also find things you forgot you had, and reduce buying duplicate items because in an organized home you can find what you’re looking for.

You could also make some cash by selling your old items or create some goodwill by donating useful items to people in need.

66. Use a thermostat

Using a thermostat is a smart way to be efficient with your heating.

Using a thermostat is a smart way to be efficient with your heating.

The Nest Thermostat claims ‘independent studies have proven that the Nest Learning Thermostat saved an average of 10-12% on heating bills and 15% on cooling bills. That means that in two years, it can pay for itself.’

That’s a serious frugal win. Check out the Nest Thermostat here.

67. Buy used where possible

Almost everything you need was needed by someone else before you. Before you invest in something new, check if you can borrow it from someone.

If that’s not possible, check out online forums and sites to buy used.

Buying used is better for the environment. You’ll often be able to buy a higher quality item, used for less than the cost of a lower quality item, new.

68. Switch to homemade cleaners

Cleaning products are one area where big savings can be made.

Lots of frugal living advocates are big on making their own cleaners and I see why.

I’ve switched to homemade cleaners (like white vinegar) in my home almost completely and it saves a lot of money.

Check out this list of homemade cleaning products for more ideas.

69. Replicate double pane windows on the cheap

If you have a cold home, this is one of my top frugal tips to save money and make your home warmer.

We live in an older home and don’t have the budget for new windows but the cold radiates off our single-pane windows, especially at night.

I was happy to discover there are some frugal ways to replicate a double-pane windows effect in old single-pane windows, without the huge price tag.

I went with the Duck Window Kit. The kit consists of clear shrink film and double-sided tape.

Essentially, you run double-sided tape along the outside edge of the window.

Then you measure and cut the film to fit the window (with around 50mm or 2 inches extra) and press it onto the double-sided tape.

The final step is going over the film with a hair dryer to remove any bunching or wrinkles. This step made the film very taut.

You can barely even see the film once it’s on. It’s truly awesome stuff!

I’ll admit I was skeptical, but we all slept better with the heater on a lower setting, and the next morning there was absolutely no condensation on either of our bedroom windows.

70. Switch to LED bulbs

One of the simplest ways to live frugally is to replace better. Don’t rush out and buy LED bulbs when your existing bulbs are still working just fine.

Just replace them with LEDs when they blow. I’ve tried to approach the LED issue as frugally as possible. First, I was only replacing with LED Bulbs when my old 60– 75-watt incandescent bulbs blew.

71. Unplug electronic devices

Many people leave devices like TVs and computers plugged in all the time, even when they’re not using them.

This wasted electricity can add up over time and increase your monthly electric bill.

72. Keep lights and fans off

Same as above. If you leave a room, turn off the lights and fans after you. It’s a small change that can make a big difference.

73. Use surge protectors

Using surge protectors is a frugal living tip that will reduce your energy bill.

By diverting excess current away from your devices, surge protectors can help to prolong the life of your electronics and prevent damage from power surges.

In addition, surge protectors can also help to save you money by preventing your devices from drawing too much power.

When devices are overloaded, they often use more energy than necessary, leading to higher energy bills.

By using surge protectors, you can help to keep your energy usage down and save money on your monthly bill.

74. Close off rooms you don’t use

If you have a room in your house that never gets used, or that you only use for storage, then there’s no reason to heat or cool that space.

By sealing off unused rooms, you can frugally reduce your energy consumption without sacrificing your comfort.

75. Set ceiling fans counter-clockwise during the summer

In the summer, ceiling fans should be set to rotate counter-clockwise. This produces a cool breeze, which can help to keep your home frugal.

In the winter, ceiling fans should be set to rotate clockwise. This produces a warm updraft, which can help to circulate heat evenly throughout your home.

76. Sell your stuff

Most of us have closets, garages, and attics full of stuff that we never use.

While it may be sentimental or even just a pain to get rid of things, selling the stuff around your home that you don’t use anymore can save you a lot of money.

Having a yard sale is a great way to get rid of clutter and make some extra cash.

77. Open windows in the morning

When you open your windows in the morning, you are allowing fresh air to circulate throughout your home.

This helps to remove stale, stagnant air that can lead to health problems. In addition, it can also help to regulate the temperature in your home, making it more comfortable and helping you to save on your energy bills.

78. Keep shades drawn

Keeping the shades drawn can lower your energy bill.

In the summer, simply closing the blinds can help to reduce the amount of heat that enters your home, making it easier to keep cool.

Keeping the shades drawn can also help to protect your furniture from fading.

UV rays from the sun can cause fabrics to fade over time, so by keeping them out you can help to keep your furniture looking new for longer.

79. Keep shades open

In the winter, you can take advantage of the sun’s warmth by opening the shades during the day and closing them as soon as the sun starts to go down at night.

By doing this, you can help to reduce your heating costs as you trap the heat from the day in.

80. Insulate your attic space

Proper insulation helps to keep heat in during the winter and cool air in during the summer.

As a result, your HVAC system won’t have to work as hard, which can help you save money on your monthly energy bills.

81. Weatherstrip

Weatherstripping is the process of sealing gaps and cracks around doors and windows to prevent drafts and help regulate indoor temperature.

In the winter, proper weatherstripping can save you money on your heating bill by keeping warm air from escaping.

In the summer, it can help keep your home cool by preventing hot air from coming in.

Weatherstripping is a simple and inexpensive way to improve your home’s energy efficiency, so it’s worth taking the time to do it right.

82. Use a space heater

Space heaters are small, portable devices that can be used to heat up a single room or area.

They are much more efficient than central heating systems, and they can save you money on your energy bill.

83. Keep filters and ducts clean

Filters and ducts play an important role in your HVAC system, helping to keep the air in your home clean and comfortable.

However, over time, these components can become clogged with dust and debris. When this happens, your system has to work harder to circulate air, which can lead to higher energy bills.

Additionally, a clogged filter can restrict airflow and cause your system to overheat. To keep the system running smoothly, be sure to clean or replace your filters and ducts on a regular basis.

84. Insulate exposed pipes

In the winter, heat escapes from your home through any exposed surfaces, and this includes your pipes.

By wrapping them in insulation, you can help to keep the heat in, reducing the amount of energy your home needs to stay warm.

In addition, insulating your pipes can help to prevent them from freezing and bursting, which can cause extensive damage.

85. Eliminate cable

There’s never been a better time to cut the cord and eliminate your monthly cable bill.

Thanks to the rise of streaming services like Netflix, Hulu, and Amazon Prime, it’s easy to find quality programming without having to pay a fortune.

Best of all, there are no contracts or hidden fees – you can cancel anytime you want.

86. Ditch the landline

With the advent of cell phones, there’s really no need to have a landline phone anymore.

Ditching your landline can save you money and provide some additional flexibility. With a cell phone, you’re not tied down to one location – you can take your phone with you wherever you go.

Frugal Family

Frugal living with kids is totally possible. Actually, I reckon I’m a whole lot better with money since my kids came along.

Kids love the simple life, which can be very cheap if you do it right. Here are my top tips for frugal family living.

87. Try to breastfeed if you can

Gosh, this is a controversial one but hear me out. I know people who don’t even try to breastfeed. They prefer to bottle feed and that’s what they do from the day of birth.

I was encouraged to breastfeed through extreme pain and eventually got the hang of it. And it’s saved me a lot of money. We’ve never needed bottles or tins of formula or bottle warmers or sterilizers.

If you can’t breastfeed, please don’t take offense to this. I know not everybody can, but if you want to have a baby on a budget, it’s a great way to keep costs down.

88. Don’t buy all the baby stuff

Your baby needs very little, but the baby stores don’t want you to know that.

I’ve prepared a helpful minimalist baby list of things you need and don’t need – check it out here.

89. Dress them in used clothing

If you’re lucky, the piles of hand-me-down clothing that are bestowed upon you at the mere utterance of a positive pregnancy test will be a welcome addition to your new frugal lifestyle.

Kids don’t need new clothing. The only things we buy new for our kids are underwear and shoes (although I do buy used shoes if I find quality items in the thrift store).

90. Talk to your kids about money

Instilling frugality in your kids is a gift that’ll reward them their entire lives.

I know it’s hard when children are surrounded by messages and advertising in the media and from their friends of new toys and must-have gadgets.

I bring my eldest grocery shopping and explain to him how much money we have to spend. We talk about our budget.

I tell him why we save what we can, so we can spend on fun family experiences like traveling or going to the zoo.

I’m not saying I have this under control yet, but I’m working on it.

I know one thing for sure, if I had learned how to be frugal when I was young, I wouldn’t have gotten into debt or had to rely on my parents to bail me out.

Educating your kids on money management is perhaps one of the best frugal living tips with a big impact, and it’s sure to save you money in the future.

91. Start frugal family hobbies

My boys love to ride their bikes, go to the beach to hunt for crabs, go foraging for fruit and go to the playground.

Other than the gas to get to the beach, none of these things cost money.

Taking part in free activities that are fun for the whole family will show your kids that a simple and frugal life is a good life.

Frugal Living Tips – Transport

92. Live car-free or car-lite

If you’ve always been a two-car family, it might be out of the realms of possibility that you could go car-lite – a fancy term for becoming a one-car family.

But cars are expensive to buy, maintain and insure so living without one can save you a boatload of cash.

If you’re looking for ways to be frugal and you haven’t considered getting rid of your car, you might want to put that on the table.

Online shopping means you can skip grocery pickup. If you live close enough to school, walking, biking or riding a scooter are great ways to spend more fun time with your kids minus the parking issues.

93. Get back on your bike

There are way more benefits of cycling than I can cover here so just know this – cycling is good for your body, mind and wallet.

Replacing shorter car trips with a bike ride is an easy way to be more frugal.

Decent pannier bags will allow you to do a grocery shop on your bike, and a bike seat for toddlers is a great way to get them into cycling at a young age.

94. Work from home

One big benefit of working from home is that you can save money on things like commuting costs and office space rent.

You also have more control over your work environment, which can make it more comfortable and productive.

And with advances in technology, it’s easier than ever to stay connected and get work done from anywhere.

95. Plan and combine your errands

Instead of making multiple trips to different stores, try to group your errands so that you can accomplish everything in one trip.

This can be especially helpful if you live in a rural area where there aren’t many close options for shopping.

96. Carpool

Carpooling reduces the number of vehicles on the road and cuts down on fuel consumption.

In addition, carpooling can be a convenient way to travel, since it reduces the need to find parking and can help ease traffic congestion.

Of course, carpooling is only frugal if you are able to find others who are willing to share the ride. But with a little planning and coordination, carpooling can be a great way to save money and help the environment.

97. Slow down

Another way to save money on gas is to use fuel-saving driving techniques.

For example, accelerating slowly and braking gradually can help to improve your gas mileage.

98. Keep your tires inflated

Tires that are underinflated can wear out more quickly, and they also require more energy to keep rolling, which means you’ll end up using more fuel.

In addition, underinflated tires are more likely to overheat, which can lead to a blowout.

99. Turn off the AC

Every time you turn on the AC, your car’s engine has to work harder, which uses more gas.

So if you’re trying to be frugal, simply turn off the AC and open your windows instead.

100. Shop around for the cheapest gas

As anyone who’s ever driven a car knows, gasoline is one of the most expensive expenses associated with vehicle ownership.

To save on gas shop around for the cheapest gas prices in your area.

Frugal Living Tips – Entertainment

101. Get to know your library

The public library is perhaps the most underrated tool in a frugalist’s toolbox.

Not only can you get borrow books, but you can also access newspapers, e-books, magazines, online courses, and more.

They also run story time and free events.

If you haven’t been to the library lately, take a look. You might be surprised!

102. Join a toy library

The Toy library has been a savior for my family in our small house.

Managing toys is a constant battle, so I’ve found that becoming a member of a toy library allows me to own fewer toys (and therefore have less toy clutter) but still have happy kids.

103. Start some frugal hobbies that make money

Taking up hobbies like gardening, carpentry, blogging, baking, and making your own jams allow you to follow a passion and increase your skills.

Plus they can make money! You can sell your home-crafted items or produce to friends and neighbors.

104. Use credit card rewards to fund fun

Everyone loves a good vacation, but often the cost of airfare and hotels can be prohibitive.

However, by using credit card rewards, it’s possible to save hundreds of dollars on travel expenses.

Many credit cards offer generous sign-up bonuses that can be used to cover the cost of flights and hotels.

Moreover, many cards offer ongoing rewards that can be redeemed for cash back or travel expenses.

By using credit card rewards, it’s possible to take the trip of a lifetime without breaking the bank.

105. Go camping

Camping is a great way to save money on lodging and entertainment expenses, and it’s also a great way to get some fresh air and exercise.

There are plenty of beautiful places to camp all across the country, so you’re sure to find a spot that suits your needs.

106. Go on a staycation

A staycation is a vacation that is spent close to home, and there are many ways to make the most of it.

One option is to visit local attractions that you’ve always wanted to see but never had the time for. You can also use your staycation as an opportunity to relax and rejuvenate.

Spend time outdoors, take a day trip, or just enjoy some quality time with your family. With a little creativity, a staycation can be just as fun and relaxing as a traditional vacation.

107. Swap Puzzles

One way to save on your puzzle budget is to swap puzzles with friends. This way, you can keep your collection fresh without spending a lot of money.

To do this, simply find a friend or neighbor who also enjoys puzzles and agrees to swap a certain number of puzzles every month.

This way, you’ll always have new puzzles to work on without having to buy them yourself. Plus, it’s a great way to get to know your fellow puzzlers better!

108. Have a game night

Board games are a fun and frugal way to entertain people of all ages.

You could host a game night for friends and family as a fun and cheap way to enjoy each other’s company.

Frugal Living Tips – Finances

When you think about how to live frugally, you probably think of cutting costs and living with less.

Whilst lower expenses are an important part of living frugal, there are other things you can do to improve your finances so you can increase your net income, while reducing your outgoings.

109. Create a budget that works for your lifestyle

A budget is a plan for where your money goes each month. The best frugal living tips won’t make a difference if you don’t have a budget.

Try to think of your budget as a tool for getting you the life you want.

Finding the right frugal living budget for you might take some time as there are lots of different ways to budget.

I budget backward, focusing on keeping my expenses low so I can save more.

There’s also zero-sum budgeting where you give every dollar a job, the 50/20/30 budget which allocates percentages of your income to different areas of your life and numerous other ways.

One of the best frugal budget tips is to include a fun money category in your budget.

That way, you have some money set aside for fun and won’t blow your budget the next time a friend asks you to meet for a coffee.

110. Pay off debt

Paying back your debt fast is another way to live more frugally as you will save money on interest payments in the long run.

We all know that the best frugality tips include spending less – that includes interest payments too! Most of us end up paying back our car, home or student loans twice when we count the interest payments.

Increasing debt payments even if it’s only by a couple of dollars is the best way to start saving on your interest bill.

An easy way to do this is to see if your lender will allow you to round up to the nearest $10 (e.g. if your payment is $342/month – round it up to $350).

Gradually increase payments where you can (you’ll be saving more from living a frugal life), and you’ll soon become pretty fired up about destroying your debt.

111. Find ways to make extra money

The best way to start saving money is to increase your income so you have some extra money to save.

A side hustle is often the only answer for people wondering how to save money when you are already frugal.

The extra income helps to pad your savings account and takes the strain off when money is scarce.

For anyone on a tight budget, frugal living will only get you so far before you have to focus on increasing your income.

There are so many ways to increase your income these days.

Money-making ideas include finding a side gig to do on the weekend or getting extra qualifications so you can earn more in your regular job.

If you’re willing to put in a little more hustle, you can build an online business like a blog or do freelance writing or virtual assistant work. The possibilities are endless. You could even sell pictures of your feet online.

112. Pay for gifts with gift cards

One of my best tips for living frugally is to avoid using your own money wherever possible.

I try to pay for Christmas and birthday gifts with gift cards earned from through online surveys throughout the year.

I can easily earn $20/month worth of gift cards in little time if I put in the effort.

Some easy ways to earn gift cards are to watch videos and play games with Swagbucks and answer polls and surveys with Survey Junkie.

113. Set a frugal Christmas budget

You don’t start wondering how to have a frugal Christmas in December.

Planning for the holidays should start at least 6 months in advance so you have time to save money.

Budgeting for Christmas will help keep this expensive time of year under control. I like to put a small amount aside each month in a dedicated account so I know I’m covered.

Related post: 69 Free Gift Ideas They’ll Totally Love

114. Get cashback on everyday purchases

Before you buy a single item, join Rakuten and check if you can get cashback first. I love Rakuten!

I get cashback on so many items including books (from BookDepository.com, travel and hotel bookings, clothes, and more).

Plus you’ll get $10 FREE when you join Rakuten and make a qualifying purchase.

Related post: Rakuten Review 2023: Save Money When You Shop

115. Save an emergency fund

Could you cover the cost of your washing machine breaking down tomorrow? If not, that means a decent emergency fund is needed.

Ensuring you have three to six months’ worth of expenses set aside in an emergency fund can help reduce stress and debt levels!

Having this money set aside will make it easier to sleep well at night so all your energy is focused on things like work or family time–not how much you owe in credit card bills.

Here are some frugal tips on how to save an emergency fund.

116. Avoid debt where possible

One of the best tips for frugal living is to avoid debt. You can do this by having an emergency fund as we’ve just talked about, and you can also do this by being intentional.

Do you need to own an item to use it? You might be able to borrow it from a friend, or barter services.

There are many ways to utilize items without ownership. Just taking the time to think through your options will help you avoid racking up credit card debt for things you might not use.

117. Use a cash-back credit card

If you’re looking for a frugal way to use credit, a cash-back credit card could be a good option.

With one of these cards, you can earn cashback on purchases, which can be a great way to offset the cost of your monthly expenses.

There are a few things to keep in mind when using a cash-back credit card, though.

First, be sure to pay off your balance in full each month to avoid interest charges.

Second, only use the card for items that you would already be spending money on – there’s no point in racking up debt just to earn cashback.

When used wisely, a cash-back credit card can be a great tool for frugal shoppers.

118. Never pay for banking

Although it may seem like a good idea to pay for banking services, frugal consumers know that there are plenty of ways to avoid these fees.

By using direct deposit, automatic bill pay, and online banking, you can avoid many of the common fees charged by banks.

Additionally, many banks offer free checking and savings accounts for customers who maintain a certain balance.

By being mindful of your account balance and keeping an eye out for promotions, you can ensure that you never have to pay a dime in bank fees.

119. Return items you haven’t used

One frugal living idea is to return items you have not used.

For example, if you buy a piece of clothing and it does not fit well or you do not like the way it looks, take it back to the store and return it.

The same goes for any other type of item, such as appliances, electronics, etc.

If you have not used it and do not plan on using it, return it and get your money back.

120. DIY where it makes sense

For many people, the allure of DIY projects is hard to resist.

Not only can they be frugal, but they also offer a sense of satisfaction that comes from completing a project with your own two hands.

However, it’s important to remember that not everything is meant to be a DIY project.

In some cases, it’s actually more expensive and time-consuming to try and do it yourself than it would be to just hire a professional.

121. Try a no-spend month

One way to get your finances back on track is to try a no-spend month.

During this month, you commit to not spending any money on non-essential items.

This can be a great financial reset button, helping you to focus on your financial goals and saving money.

122. Cancel subscriptions

If you’re looking to reduce your monthly bills, one easy way to do so is to cancel any subscriptions that you no longer use.

This can apply to anything from unused gym memberships to streaming services that you never watch.

The rule in our family is that we only keep a streaming service subscription for one month at a time.

If we have a series we are really into, we can always extend the subscription. But mindlessly paying the subscription fee monthly adds up!

123. Repair don’t replace

There’s a saying that goes, “If it ain’t broke, don’t fix it.”

But what about when it is broken? Is it always worth rushing out to buy a replacement, or can you save some money by trying to fix the item first?

It may take some time and effort, but in many cases, you can successfully repair broken items instead of replacing them.

124. Look for free ways to exercise

You don’t need a gym membership or fancy equipment to get fit.

Taking a brisk walk or run in your local park is a great way to get some fresh air and exercise for free.

If you’re looking for something more structured, there are often community groups that offer free classes in everything from dance to yoga.

And if you have a bit of space at home, there are plenty of Youtube videos and online resources that can help you create your own workout routine.

125. Shop clearance racks

Shopping clearance can be a smart way to reduce your spending on essential items like clothing, footwear, and sports gear.

You can get high-quality items without having to pay full price.

Next time you go shopping for new gear, check out the clearance options first.

126. Ask for price matching

Most stores have price matching policies (not Costco, unfortunately). If you find an item at a store, run a quick search on your phone to see if is cheaper elsewhere.

Then ask the store to match the cheaper price. This is so much easier than driving around multiple stores to get the best price.

127. Pay your bills on time

Many service providers charge overdue fees on bills. Some even offer a discount for early payment.

Be sure to pay your bills on time so you don’t pay more than you need to.

I prefer to set auto-pay for my bills so I know I won’t ever miss a payment.

128. Set up automated savings

One of the best frugal living tips I use is to automate your savings.

This means setting up an auto-payment from your checking account to a savings account as soon as your paycheck hits.

You won’t even notice the money is gone and it’ll add up over time.

129. Refinance loans

If you have significant debt at high-interest rates, you could look into refinancing.

This is not a decision to take lightly but it can help reduce your per month outgoings if done correctly.

130. Quit smoking, drinking, and eating fast food

Smoking, drinking, and eating fast food are all bad habits that can have a major impact on your health and finances.

Quitting these bad habits can be difficult, but it is worth the effort.

131. Maintain your stuff

Regular maintenance on the things you own can save you money in the long run.

For example, if you have a car, it is less expensive to get the oil changed regularly and to fix small problems before they become big ones.

The same is true for your house; by fixing a leaky faucet or patching a hole in the wall as soon as you notice it, you can avoid more costly repairs later on.

In addition, maintaining your belongings can help them last longer.

A well-cared-for shirt or pair of shoes will last longer than one that is allowed to become stained or ripped.

132. Avoid impulse purchases

An impulse purchase is something that you buy on the spur of the moment, without planning or thought.

It’s easy to get caught up in the excitement of a sale or a good deal, but it’s important to remember that not every purchase is a good deal.

If you take the time to think about whether or not you really need or want something, you’re much less likely to make an impulse purchase that you’ll regret later.

133. Check bills and credit card statements

It’s always a good idea to check your bills and credit card statements carefully.

This way, you can make sure you’re not being overcharged. If you see something that doesn’t look right, don’t hesitate to contact customer service and ask about it.

134. Shop around for insurance

There are a lot of things to consider when you’re shopping for insurance.

You want to make sure you’re not paying too much, but you also want to make sure you’re getting the coverage you need.

The best way to do this is to compare rates from different insurers.

Once you have a few quotes, you can start to narrow down your options. Consider the coverages each policy offers and decide which one is right for you.

135. Cash in all your coins

It may just seem like (literal) pennies on the dollar but many pennies, nickels, dimes and quarters add up to a substantial balance.

We recommend regularly cashing in your coins somewhere like a Coinstar machine (use our tips to avoid the fee) or your local bank if they offer a low cost way to cash in your change.

Either way – it’s your money, don’t let it disappear down the back of the sofa for good!

Frugal living has completely changed the outcome of my life. It’s allowed me to get out of debt, invest for the future, build an online business and travel the world with my family.

After years of feeling like understanding finances was beyond me, I now feel like a financial success.

Frugal living comes as a result of many small changes and can take some time to implement.

Focus on the long game and the exponential benefits of making small frugal changes to your life, and you’ll be just fine.

What are your top frugal living tips?

Frugal Lifestyle Tips – FAQS

How to Be Frugal Without Being Cheap?

Frugal and cheap are often used interchangeably but they are not the same.

As an example, someone following a frugal lifestyle would research and ensure they were getting the best price on an item they needed, and buy the best quality they could afford.

That smart frugal person knows that buying quality costs less in the long term.

A cheap person would buy the cheapest version of the thing they require, and it would probably break on them.

The frugal person would happily save money on things like fancy meals and designer labels so they can enjoy a family vacation (or staycation) every year because living a frugal life means balance.

A great example of how to be frugal without being cheap is when you go out for dinner.

You might choose to just have a starter instead of a main meal or entrée, drink table water instead of wine and still give a generous tip. That’s frugal. A cheap person would skimp on the tip.

Why do you want to live more frugally?

I can tell you how to live frugally and save money but before I do, I’d really like you to dream big.

Write your bucket list. You know, all those things you’ve always dreamed of doing but never got around to because you were working, too busy with life or just plain did not have the money?

Write all those things down. Since you’re on your way to a more frugal life you’ll have more money and more time, so those dreams of yours are gonna come true.

Learning how to live frugal took me from up to my eyeballs in debt to financial freedom. I have no doubt it can do the same for you.

Related guides:

- 27 Super-Useful Ways to Save Money on Groceries

- 16 Free Budgeting Printables To Save Money

- 12 Awesome Benefits of Budgeting Your Money

- 11 Things I Stopped Buying to Save Money (That I Really Don’t Miss)

- 5 Signs You’re Frugal Not Cheap (Yes They’re Different)

- Frugal Living Tips From the Great Depression (That Still Work Today)

- Get Paid to Sign Up: 11 Sites That Pay You To Join