Wondering what the 50/30/20 budget is all about?

If you’re looking for a little more simplicity in your life, or are brand new to the idea of living on a budget, you may want to consider the 50/30/20 budget rule.

It will help you control your spending and work toward your financial goals, but it allows for a little more freedom than what you may be used to when it comes to budgeting.

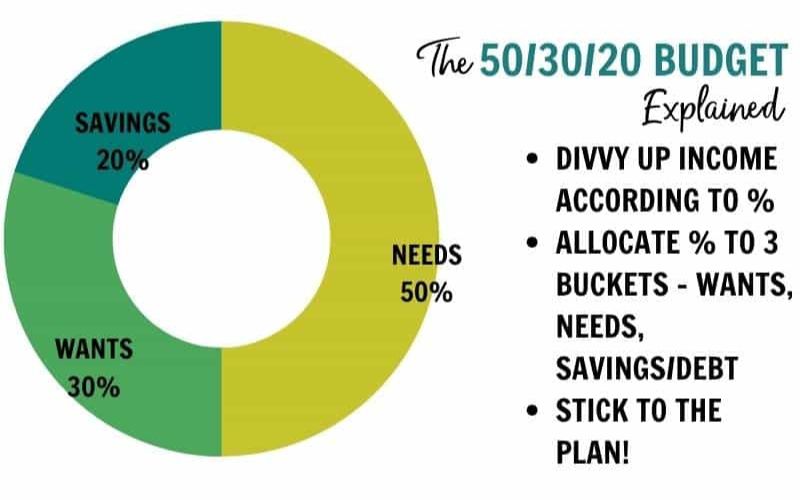

What is the 50/30/20 Budget Rule?

There are a lot of experts who claim to have the perfect solution to your money problems, and they all have one thing in common. All of them require you to budget your money.

There are a lot of different ways to divvy up your expenses, and whichever method you choose depends on your goals and lifestyle.

But the bottom line is that you have to live on a budget to achieve any level of financial success.

I’m a big fan of the zero-sum budget but many people like the simplicity of the 50/30/20 rule.

With a zero-sum budget, you divide your expenses into specific categories like rent, groceries, petrol, entertainment, credit card payments, car insurance, and utility bills.

Every dollar has a job, and you plan how to spend every cent.

The 50/30/20 rule tries to make budgeting a little easier.

Instead of 20 or 30 different budget categories, you divide your income into three buckets: needs, savings and debt, and “wants.”

As long as you don’t spend more than 50 per cent on needs, 20 per cent on savings, and 30 per cent on everything else, you’re free to spend your money however you’d like.

50 percent goes toward needs

As with any budget, you must take care of your basic needs before allocating money for other expenses.

Typically, you need food, rent or mortgage payments, prescription medication, car insurance, health insurance, car loans, student loans, minimum credit card payments, electricity and other utility bills, and fuel for your car.

Basically, it boils down to making sure you take care of food, shelter, and transport costs first.

The hard part is determining what is a “need” and what is a “want.”

For instance, a “need” does not include your unlimited data package with your mobile phone plan, your Netflix subscription, or buying clothes anywhere other than a discount clothing store.

20 percent is for savings

The most significant part of the 50/30/20 budget rule is the 20 per cent you put toward your financial goals.

This part of your budget plan includes saving for retirement and ensuring your emergency fund has enough money to cover unplanned life events.

But this also includes putting additional money toward your debt payments to eliminate them and eventually become debt-free.

While the minimum amount is considered a “need,” this extra money you pay is applied to the principle.

It reduces your future obligations and is part of the savings category.

30 percent is earmarked for discretionary expenses

To help decide the difference between a need and a want, think of discretionary expenses as making life more fun.

It includes streaming packages, new shoes, salon haircuts, a trip to the Islands, and dining out at restaurants.

It also includes gym memberships, having dinner at a restaurant or ordering takeaway, your morning flat white, and buying gifts for birthdays and Christmas.

Pros and Cons of the 50/30/20 Budget

Budgeting, like weight loss, only works if you stick to the plan. Different budgets work for different people, and there are pros and cons of using the 50/30/20 rule.

Pros

- It’s simple – Instead of keeping track of every single category, you only think about three. When dividing up your income, you simply put the right amount of money into needs, wants, and savings. It doesn’t get much easier than that.

- You get fun money – When working on your financial goals, it’s easy to fall into the “all or nothing” mindset and forget to allocate money for the fun stuff in life. This rule has a built-in budget for fun money that you can use for shopping, going to the movies, or anything else you want.

- It can help reduce your fixed costs – Huge mortgages and high debt balances have driven most households to live on 75 per cent or more of their monthly income. Working toward using only half of your income for needs and fixed costs will free up more money to put toward your long-term financial goals.

Cons

- It allocates too much disposable income – Setting aside 30 per cent of your income for “wants” is a massive chunk of money. Blowing this much cash on things that don’t matter in the long run is wasteful and won’t help you toward your long-term financial goals.

- It’s not specific – Most people struggle with money because they don’t have a plan. This budget is better than nothing, but it isn’t detailed enough to make a lasting impact on the health of your finances.

- It doesn’t help when money is tight – If you’re struggling to pay your bills or living paycheck to paycheck, you might not have the financial breathing room for this type of budget.

Who Should Consider the 50/30/20 Budget?

Creating a zero-sum budget can seem overwhelming if you’re new to budgeting or money management.

The 50/30/20 budget is easy to do without a complicated spreadsheet.

It simplifies the process of figuring out how much money you can spend and what you can spend it on.

Some people have a hard time saving money, and this budget can help.

By creating a specific amount of your income to set aside each month, you won’t have trouble building up your savings account.

Most of the problem with a budget is carefully keeping track of your transactions.

Using the 50/30/20 rule can help because it reduces the need to monitor every purchase.

If you haven’t had much success in the past with sticking to a budget, this might be enough to keep you focused.

Who Should Avoid the 50/30/20 Budget?

Having a lot of debt will make using the 50/30/20 budget more difficult.

Adding up the minimum payment of your credit card bills, car loans, student loans, or personal loans can put you over the 50 percent recommended amount for needs.

In that case, you can work toward lowering your fixed expenses to get them below 50 percent, but you won’t be able to start there.

High-income earners won’t benefit over the long term from using this budget, but neither will people with lower-than-average incomes.

For instance, if you’re making close to minimum wage and your income is $17,000 a year, that leaves you with roughly $700 to spend on needs and fixed expenses.

In most areas, that won’t even cover the cost of rent.

For those high-wage earners on the other end of the spectrum, using this rule could let you spend a large portion of your income on discretionary expenses.

Instead of wasting your money on entertainment, fine dining, and other luxuries, choosing to save or invest the excess is much better for your financial health.

If you’re in between jobs, using this percentage-based budget probably won’t work for you, either.

Instead, you’ll need to trim down your spending as low as you can and preserve as much cash as you can until you’re earning a regular paycheck again.

Tips for Budgeting With the 50/30/20 Budget Rule

If your income and expenses don’t line up with the percentages, you’ll have to make some adjustments.

Increasing your income is one option, but the best place to start is by taking a hard look at your expenses to see if there are any areas where you can cut back.

Here are some options that can quickly reduce your fixed expenses:

- Install a programmable thermostat to save on heating and cooling

- Reduce the amount of electricity you use by unplugging unused electrical devices and using timers and power boards

- Cancel your gym membership

- Eliminate your streaming bills

- Stop going out to eat and cook your own meals at home

- Pack lunch to bring to work

- Shop around for cheaper home and car insurance

- Downsize your home or move to a less expensive area

Check out this list of frugal living tips for more ideas.

Should You Try the 50/30/20 Budget?

The 50/30/20 budget combines flexibility with discipline, guiding you to stop overspending and start to live within your means.

Plus, it’s entirely customizable. If these percentages don’t work for your finances, you can try a 60/20/20 or a 40/20/40 budget instead.

You need to live on a budget to get out of debt and increase your savings and investments. It isn’t fun, but it doesn’t have to be torture.

Using a percentage-based budget like the 50/30/20 budget can simplify your money and give you a spending plan you can stick to without much extra work.