I’ve found putting rules in place around how I use money has helped me to not spend so much of it on stuff I don’t need (or remember buying).

I wrote this article in 2015 while booking flights back to New Zealand after living in Spain.

The context is dated, but the message remains the same.

I still use these rules to get myself back on track when it feels like lots of money is coming out of my bank account and disappearing to places unknown.

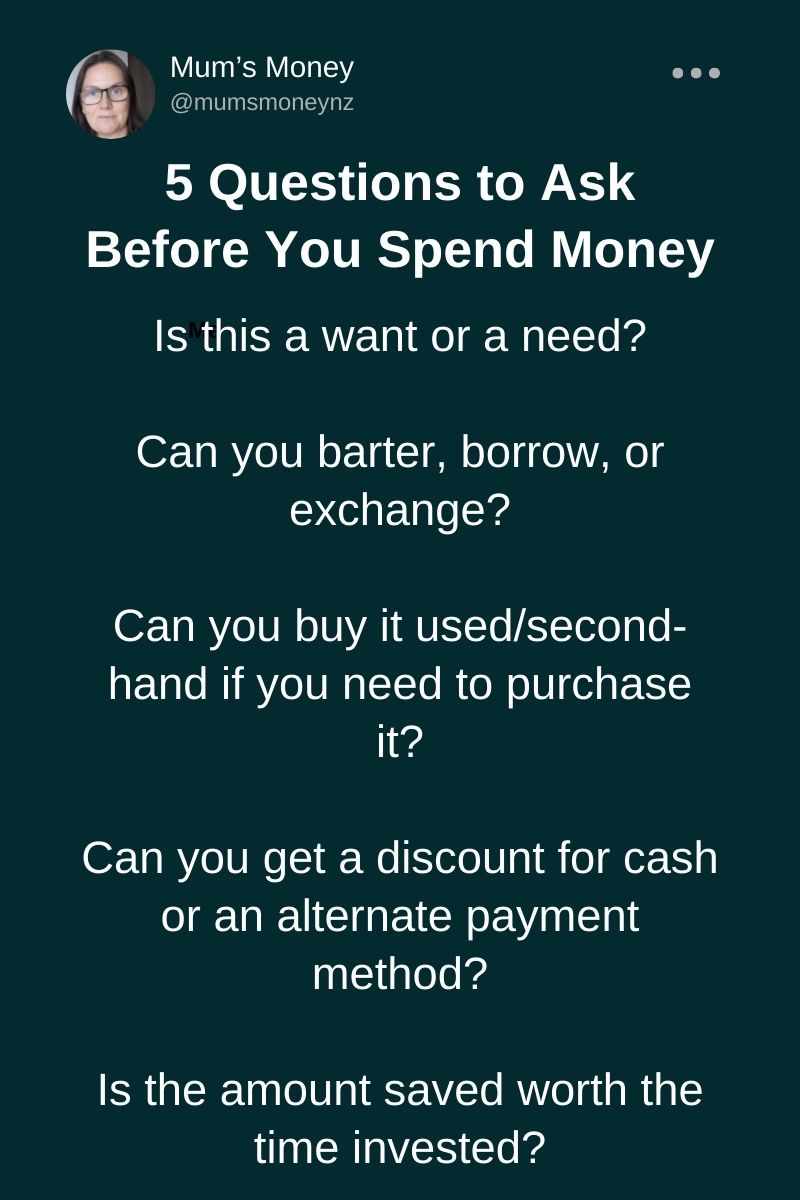

Five Questions I Ask Myself Before Making a Purchase

This week, I must pay my travel agent for flights back to New Zealand.

I was going around in circles to find the best value fare that would allow a stopover in a new and exciting city.

I emailed the travel agent, and within hours we had selected a fare and a brand new city to explore – Hong Kong!

As with so many companies these days, the travel agent charges a 2% merchant fee for using a credit card for payment.

We had 7 days to pay (another benefit of using an agent!), so I ran the numbers to see if an international transfer would save us more than the 2% merchant fee.

Why?

It’s my new rule to question every expense to find out whether it’s possible to achieve the same outcome for a lower amount and if it is, whether the amount saved is worth the time invested.

Firstly, I had to work out how much paying with a credit card would cost me.

I figured there was a saving of between $130 and $155 if I transferred the money into our Irish bank account and paid in Euros with a debit card.

If I value my time at $20 per hour (the minimum at which i would work in a job), then the task of saving money must take less than 6 hours to be worthwhile.

Needless to say, I took the option of transferring money via CurrencyFair.

(2024 Edit: I now use Wise for international currency transfers).

The initial transfer was made late Sunday night European time and arrived in the Irish bank account by midnight Monday.

Less than 24 hours after I sent it! And for 3 euros. Take that big banks!

So for the initial pain of getting set up with a new provider – simply uploading ID documents and making an initial deposit – and 30 minutes familiarising myself with their easy to use interface I was over $150 better off.

Five Questions to Ask Yourself Before Every Purchase

1. Is this a want or a need?

Depending on where you’re at in your financial journey, some wants might be ok.

Flying home for us was most definitely a need.

Getting new jeans because I’m sick of the same old pair – that’s a want for me.

2. Can you barter, borrow or exchange?

Does a friend have the item you want?

Could you swap it for something you have?

It doesn’t work for flights, but it could work for a skillsaw you need for a one-off project.

3. Can you buy it used/second-hand?

If you need it, chances are someone else did at one point.

And they might not need it anymore. Let them wear the depreciation and buy quality second-hand.

You’ll almost always get a better product if you buy a reputable brand used rather than buying the cheapest brand new.

4. Can you get a discount for cash or an alternate payment method?

You won’t know unless you ask.

This could be a cashback offer through a bank or cashback company, an offer through a loyalty program, etc.

You could also search for a coupon code online.

Do your research before you part with those hard-earned dollars.

5. Is the amount saved worth the time invested?

I spent 30 minutes learning how to use the CurrencyFair interface and saved over $150. In this instance, my time was well spent.

But driving across town to a supermarket offering half-price milk is probably not worth my time.

Read next: 9 Benefits of Frugality That Are More Important Than Money