Planning to open a new bank account or just explore the banking options in New Zealand?

You’re in luck, as New Zealand offers a variety of local and international banks catering to a wide range of financial needs.

It’s worth familiarising yourself with their distinctive services to make the best choice that aligns with your needs.

Navigating through the list of banks in New Zealand can be overwhelming, but knowing a few notable names can help you narrow down your choices.

From local banks such as Bank of New Zealand and Kiwibank to international banking giants like Citibank and HSBC, you’ll find a vast array of options addressing various financial products and services, such as personal accounts, mortgages, and business banking solutions.

As you consider various options, it’s essential to evaluate your financial goals, the types of transactions you’ll frequently undertake, and the degree of customer service you expect from your chosen bank.

By doing so, you’ll efficiently navigate through the multitude of choices and make an informed decision to accomplish your financial objectives.

Table of Contents

History of New Zealand Banks

In the early days of banking in New Zealand, the country saw the establishment of its first banks in the 1840s.

As you look back, you’ll find that some of these banks, such as the Bank of New Zealand, persist today.

During their inception, there were stringent laws governing the operations of banks and other financial institutions.

Through the years, the banking system in New Zealand has undergone various transformations.

In the 1980s, significant changes took place, resulting in the modern banking landscape you are familiar with today.

For instance, TSB made history by being the first bank in New Zealand to develop ATMs in 1981, which signified the beginning of a new era of convenience (TSB).

As of now, there are 27 banks registered with the Reserve Bank of New Zealand.

To keep up with the evolving financial needs and maintain stability, each of these banks must adhere to the regulations set by the Reserve Bank of New Zealand.

Major New Zealand Banks

ANZ Bank New Zealand

ANZ Bank New Zealand is one of the largest banks in the country, providing a wide range of services, including personal, business and institutional banking products.

You’ll find everything from everyday transactional accounts to mortgages, loans and credit and debit cards through ANZ.

Bank of New Zealand

Another significant player in New Zealand banking is the Bank of New Zealand (BNZ).

BNZ offers various financial products and services, catering to the needs of individuals, business owners and large corporations alike.

Notably, they are pioneers of the first offset mortgage in New Zealand – Total Money.

This market-leading product offers customers the chance to offset their home loan balance with cash deposits from up to 50 linked bank accounts.

Other banks – Kiwibank and Westpac quickly followed suit with their own offset products.

With a broad selection of account options, funds and competitive lending solutions, you’ll find something to suit your banking requirements.

ASB Bank

ASB Bank is another popular option for banking in New Zealand.

This bank has been around for more than 170 years and continues to provide customers with a comprehensive suite of financial products.

ASB Bank is a wholly-owned subsidiary of the Commonwealth Bank of Australia (CBA), one of the largest banks in Australia.

In 1989, the owner of ASB Bank, ASB Community Trust, sold 75% of the shares to Commonwealth Bank, and in 2000, Commonwealth Bank acquired the remaining 25%

From current accounts, savings accounts, and home loans, to investments and insurance, you’ll discover a wealth of options to suit your personal and business needs at ASB Bank.

Westpac New Zealand

Westpac New Zealand is another prominent bank offering a variety of services to cater to your financial needs, including bank accounts, home loans, credit cards, Kiwisaver, foreign exchange and more.

With a solid commitment to customer service and supporting the local community, this bank is an excellent choice for your New Zealand banking experience.

These four major banks in New Zealand—ANZ Bank New Zealand, Bank of New Zealand, ASB Bank, and Westpac New Zealand—offer you a range of financial products and services to choose from.

Regional and Community Banks

New Zealand is home to various regional and community banks that cater to the unique needs of local customers.

In this section, we will discuss four prominent regional banks in New Zealand: Kiwibank, SBS Bank, TSB Bank, and The Co-operative Bank.

Kiwibank

Kiwibank is a familiar choice for many New Zealanders, as it is one of the largest banks in the country.

Launched in 2002, it is a state-owned bank operated by New Zealand Post.

Kiwibank offers a wide range of financial services, including personal banking, business banking, and investment options.

You’ll find numerous branches and ATMs throughout New Zealand, making it a secure and convenient choice for your banking needs.

SBS Bank

SBS Bank also known as Southland Building Society, has a long history dating back to 1869.

It is a community-focused bank that prioritises customer service and relationship building.

Some of the services they offer include home loans, personal loans, and day-to-day banking.

You can find SBS bank branches primarily in the South Island, with some locations in the North Island as well.

TSB Bank

TSB Bank, founded in 1850, is another option for you to consider when seeking a regional bank in New Zealand.

It is an independently owned and operated bank headquartered in New Plymouth.

TSB Bank provides a variety of services such as savings accounts, home loans, and insurance products.

The Co-operative Bank

The Co-operative Bank is a customer-owned bank established in 1928, previously known as PSIS.

As a co-operative, it focuses on meeting the needs of its members and giving back to the community.

Services offered by The Co-operative Bank include everyday banking, loans, and insurance.

They also provide a “fair rate pricing” policy, ensuring that members get competitive interest rates on their loans and savings.

Foreign Banks with New Zealand Operations

HSBC

If you’re looking to bank with a multinational financial institution in New Zealand, HSBC operates as a subsidiary of one of the world’s largest banking and financial services organisations.

With its strong global presence, HSBC can offer you:

- Personal banking options such as savings accounts, home loans, and credit cards

- International banking services, including multi-currency accounts

- Business banking solutions tailored to meet your specific needs

Citibank

Another well-established foreign bank with a presence in New Zealand is Citibank.

As part of the global Citigroup, Citibank provides a commercial bank service for businesses to take advantage of, such as:

- Access to corporate banking products

- Capital market and investment banking expertise

- Specialised solutions for businesses, including trade and treasury services

Rabobank

If you’re involved in the agricultural sector, Rabobank is a foreign bank in New Zealand with a focus on food and agribusiness financing.

With its global reach and expertise in agricultural banking, Rabobank can offer:

- Rural-focused financial products like farm loans, equipment finance, and insurance

- Industry research and access to a network of local and international agricultural experts

- Personal banking services to support your rural endeavours, including transaction accounts and savings products

Remember that each foreign bank’s offerings may vary, so it’s essential to explore their products and services to determine what best fits your financial needs and preferences.

Banks Specialising in Business and Investment

Heartland Bank

Heartland Bank is a New Zealand-based bank that focuses on providing tailored financial services to small and medium-sized businesses.

They offer a range of business banking solutions to help your venture succeed, such as:

- Business loans

- Asset finance

- Invoice finance

- Foreign exchange

Their dedicated team of relationship managers can work with you to understand your unique business needs and develop bespoke financial strategies.

You can enjoy competitive interest rates and flexible repayment terms that cater to your business requirements.

Bank of China New Zealand

Bank of China New Zealand, a subsidiary of the global Bank of China, offers a range of financial services to support your business and investment operations.

Their business banking products include:

- Trade finance

- Term loans

- Overdraft facilities

- Letters of credit

As an international bank, they can also help you navigate the complexities of cross-border trade, providing efficient services and solutions for import and export business needs.

You can benefit from their extensive network and expertise in the global market, enabling your business to expand and thrive.

Regulatory Bodies

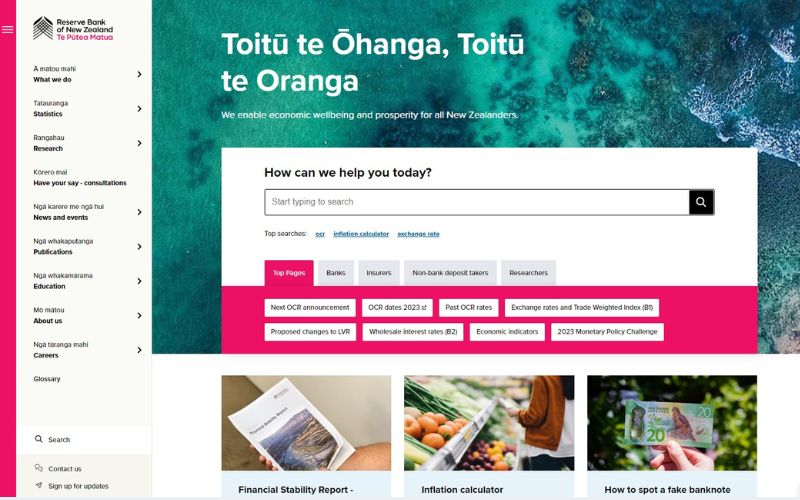

Reserve Bank of New Zealand

The primary regulator of banks in New Zealand is the Reserve Bank of New Zealand (RBNZ).

As a New Zealand bank, you must be registered with the RBNZ before you can operate in the country.

There are currently 27 banks registered with the RBNZ, which conducts regular supervision to ensure compliance with regulatory requirements.

As a registered bank, you need to comply with the RBNZ’s prudential requirements, which they impose through conditions of registration (CORs).

These requirements cover various aspects of your bank’s business, including capital adequacy, liquidity, and risk management.

The RBNZ also oversees your bank’s conduct and monitors its overall financial stability.

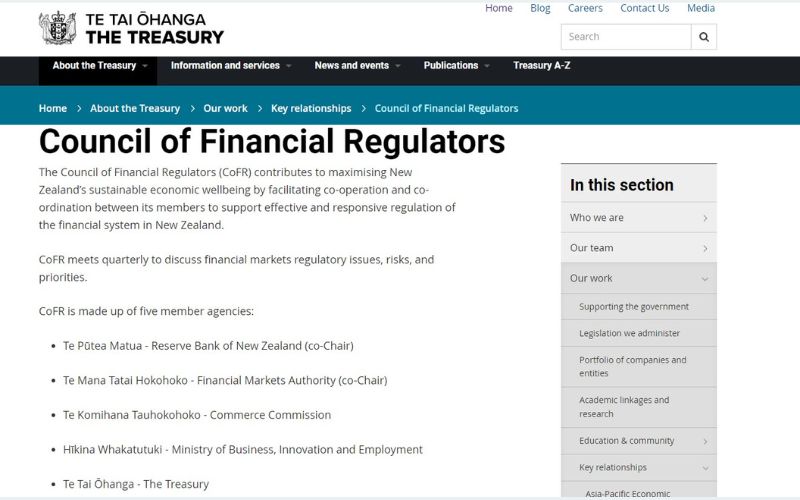

Council of Financial Regulators

Another regulatory body you should be aware of is the Council of Financial Regulators (CoFR).

This agency consists of several member authorities, including the RBNZ, the Financial Markets Authority (FMA), and the New Zealand Treasury.

The main objective of the CoFR is to promote a stable and efficient financial system by coordinating the efforts of its member agencies.

Conduct of Financial Institutions (CoFI) Legislation

Introduced by the Financial Markets Authority (FMA), the Conduct of Financial Institutions (CoFI) is a new regulatory regime that aims to ensure registered banks, licensed insurers, and licensed non-bank deposit takers comply with the fair conduct principle when providing relevant services to consumers.

New Zealand banks must adhere to the CoFI legislation guidelines to maintain good conduct and protect the interests of their customers.

New Zealand Bank Codes

New Zealand banks are identified by a 2-digit prefix.

This identifier system helps distinguish transactions belonging to different financial institutions.

Here is a chart of bank prefixes in New Zealand:

| Bank | Prefixes |

|---|---|

| ANZ | 01, 04, 06, 11, 25 |

| ASB | 03 |

| Bank of New Zealand | 02, 08 |

| Kiwibank | 38 |

| Citibank | 31 |

| Bank of China | 88 |

| National Bank of New Zealand | 06 |

Interesting facts about NZ bank codes

Here are some additional notes about bank prefixes in New Zealand:

- ANZ uses multiple prefixes as it merged with other banks over time like National Bank.

- ASB stands for Auckland Savings Bank and uses 03 as its sole prefix.

- Bank of New Zealand (BNZ) is one of the oldest banks in New Zealand, established in 1861. It uses the 02 and 08 prefixes.

- Kiwibank is a New Zealand government-owned retail bank established in 2002. It uses 38 as its prefix.

- Citibank offers personal and business banking services in New Zealand. It uses 31 as its prefix.

- Bank of China (New Zealand) Limited is a subsidiary of Bank of China and caters to Chinese communities and businesses in New Zealand. It uses 88 as its prefix.

- National Bank of New Zealand was merged into ANZ in the 1990s, but ANZ still uses 06 as one of its prefixes due to this historical acquisition.

- Other smaller foreign and domestic banks may also operate in New Zealand but the above covers the major retail banking players and their established two-digit prefixes.

Conclusion

The New Zealand banking sector is dominated by large Australian banks through their New Zealand subsidiaries.

These major banks include ANZ, ASB, BNZ, and Westpac, which have total assets of between 11% and 17% of their parent group’s total assets.

They also have high credit ratings by international standards.

While examining the list of banks, you’ve noticed 27 registered banks currently operating in New Zealand.

The banking system’s total assets amount to over $695 billion as of March 2022.

Despite facing challenges during the global pandemic, banks operating in New Zealand collectively made more than $6 billion in 2021.

This speaks to the resilience and stability of the New Zealand banking sector.

With a better understanding of the banking landscape, you’ll be better equipped to handle your financial matters in New Zealand.

FAQ – New Zealand Banks

What are the four major banks NZ?

The four major banks in New Zealand are ANZ, ASB, BNZ, and Westpac.

These four banks are Australian-owned and responsible for 85% of bank lending in New Zealand.

What international banks are in New Zealand?

There are several international banks operating in New Zealand, including Citibank, HSBC, and Bank of India.

Additionally, ANZ and Westpac, two of the four major banks in New Zealand, are Australian-owned, and other banks, such as BNZ and ASB, are subsidiaries of large international banks.

Which bank is in both Australia and New Zealand?

The bank that is in both Australia and New Zealand is ANZ (Australia and New Zealand Banking Group Limited).

ANZ is an Australian multinational banking and financial services company headquartered in Melbourne, Australia, and is the fourth-largest bank by market capitalisation in Australia and the largest bank in New Zealand.

Which banks are NZ owned?

According to the Reserve Bank of New Zealand, there are five New Zealand-owned banks: Kiwibank, TSB, SBS Bank, The Co-operative Bank, and Heartland Bank.

Which is the best bank in New Zealand?

There is no one “best” bank in New Zealand as different banks may offer different products and services that suit different customer needs.

However, there are various surveys and awards that rank banks based on customer satisfaction, fees, interest rates, and other factors.

According to a recent survey by Canstar, TSB Bank was named New Zealand’s best bank for the sixth consecutive year, based on customer satisfaction (source: NZ Herald).