Offset mortgages have become increasingly popular in recent years as a way to save money on mortgage repayments.

But how exactly does an offset home loan work, and what are the benefits of using one?

Essentially, an offset account is a savings account that is linked to your home loan.

The balance of the savings account is offset against the balance of your home loan, meaning that you only pay interest on the difference between the two.

In this article, we will explore the ins and outs of offset home loans, including how they can help you save money on your mortgage, and what you need to know before signing up for one.

Table of Contents

- What is an offset home loan?

- How does an offset home loan work?

- Benefits of an Offset Home Loan

- Disadvantages of an Offset Home Loan

- Which New Zealand banks have offset accounts?

- Frequently Asked Questions – Offset Mortgage

- Does an offset savings account still earn interest?

- Does an offset mortgage mean I’ll repay my mortgage faster?

- Can you link more than one account to an offset mortgage?

- A revolving credit loan and an offset mortgage sound the same. What’s the difference?

- Do I have access to my savings if I have an offset mortgage?

- Can you make lump sum repayments with an offset mortgage?

- Can I get an offset mortgage for an investment property?

- How We Use an Offset Mortgage

What is an offset home loan?

An offset home loan is a type of mortgage that allows borrowers to reduce the amount of interest they pay on their home loan by offsetting their savings against their loan balance.

Essentially, an offset account is a savings account that is linked to your home loan account.

The balance in your offset account is then subtracted from the balance of your home loan when interest is calculated, which means you only pay interest on the difference.

For example, if you have a home loan of $500,000 and an offset account with a balance of $100,000, you would only pay interest on $400,000 of your home loan.

This can result in significant savings over the life of your mortgage, as you will be paying less interest overall.

Offset home loans can be either partial or full offset.

With a partial offset account, only a portion of the balance is offset against your home loan, while with a full offset account, the entire balance is offset.

Full offset accounts generally offer the greatest savings, but they may also come with higher fees and interest rates.

How does an offset home loan work?

Essentially, an offset account is a transaction or savings account that is linked to your home loan.

The balance of this account is then offset against the balance of your home loan, reducing the amount of interest you pay.

For example, let’s say you have a home loan with a balance of $500,000 and an offset account with a balance of $50,000.

With an offset home loan, the interest charged on your home loan would only be calculated on the difference between the two balances ($500,000 – $50,000 = $450,000).

This means you would only pay interest on $450,000, rather than the total $500,000.

It’s important to note that an offset account doesn’t actually pay off any of your home loans. Instead, the balance of your offset account is used to reduce the amount of interest you pay on your home loan.

This means you can still access your savings in the offset account whenever you need them, while still benefiting from the interest savings.

It’s also essential to make sure you have enough funds in your offset account to make a significant difference to your interest payments.

If you don’t have a significant cash savings balance to use, you’ll get very little benefit from an offset account.

In fact, you’ll probably end up paying more in loan repayments due to the floating rate nature of an offset account.

Benefits of an Offset Home Loan

Saves Money on Interest Payments

Any money you have in your savings or transaction account will be offset against the balance of your home loan.

This means that the interest you pay on your home loan will be calculated on a reduced balance, which can save you money over the life of your loan.

For example, if you have a home loan balance of $500,000 and you have $50,000 in your linked savings account, the interest on your home loan will be calculated on a balance of $450,000.

This means you will pay less interest over the life of your loan than you would if you didn’t have an offset account.

Reduces the Loan Term

Not only can an offset home loan save you money on interest payments, but it can also help you pay off your loan faster.

By reducing the amount of interest you pay on your loan, more of your repayments go towards paying off the principal of your loan. This can help you pay off your loan faster and reduce the overall term of your loan.

For example, if you have a 30-year home loan and you use an offset account, you may be able to pay off your loan in 25 years or less.

This can save you thousands of dollars in interest payments over the life of your loan.

Flexibility to Access Funds

Another benefit of an offset home loan is that it gives you the flexibility to access your funds when you need them.

Unlike a fixed-rate home loan, which may charge you fees for making extra repayments or withdrawing funds, an offset home loan allows you to withdraw your funds without penalty.

This can be particularly useful if you have unexpected expenses or if you want to take advantage of investment opportunities.

By keeping your funds in an offset account, you can earn interest on your savings while still having the flexibility to access your funds when you need them.

Disadvantages of an Offset Home Loan

Higher Interest rates

While offset accounts can save you money on interest payments, in New Zealand, they tend to come with higher interest rates than regular home loans.

This is because New Zealand offset mortgage options are all on floating interest rates, which are significantly higher than a fixed rate.

Always compare the interest rates of different offset home loans and ensure that the savings from the offset account outweigh the higher interest rate you pay for the privilege.

Fees and charges

Another factor to consider before getting an offset home loan is the fees and charges associated with the loan.

Offset home loans may come with higher fees and charges than regular home loans, including annual fees, establishment fees, and ongoing fees.

Make sure to compare the monthly fees and charges of different offset home loans and ensure that the savings from the offset account outweigh the higher fees and charges.

Eligibility requirements

It is essential to ensure that you meet the eligibility requirements before applying for an offset home loan.

Some lenders may require a minimum deposit or minimum balance in the offset account and may have other eligibility requirements.

Which New Zealand banks have offset accounts?

BNZ, Westpac and Kiwibank all offer offset mortgages.

| 100% offset allowed | Maximum linked accounts | Monthly fee | Establishment fee | |

| BNZ Total Money | Yes | 50 | $10 | yes |

| Westpac Choices | Yes | 10 | $5 | yes |

| Kiwibank Offset | Yes | 8 | none | yes |

Frequently Asked Questions – Offset Mortgage

Does an offset savings account still earn interest?

In New Zealand, offset savings accounts typically do not earn interest, as the balance of the account is used to offset the balance of the mortgage and reduce the amount of interest charged.

When you have an offset mortgage, the balance of your savings account is linked to your mortgage, and the interest charged on your mortgage is calculated based on the net balance (mortgage balance minus savings balance).

This means that the more money you have in your offset savings account, the less interest you will pay on your mortgage.

While offset savings accounts do not earn interest, the potential interest savings from the reduced mortgage interest charges can be significant, especially over the life of the mortgage.

Does an offset mortgage mean I’ll repay my mortgage faster?

An offset mortgage has the potential to help you repay your mortgage faster, but this will depend on the structure of the mortgage and how you use the offset account.

The main benefit of an offset mortgage is that the balance of your savings account is offset against the balance of your mortgage.

This means that you only pay interest on the difference between your mortgage balance and your savings balance.

By reducing the amount of interest charged on your mortgage, an offset mortgage can help you reduce the overall amount of interest you pay over the life of the loan.

If you continue to make your regular mortgage payments but use your offset account to hold your savings and reduce the amount of interest charged on your mortgage, you may be able to repay your mortgage faster than you would with a traditional mortgage as more of the monthly repayment will be going towards paying the principal and increasing your equity.

Can you link more than one account to an offset mortgage?

Yes, it is possible to link more than one account to an offset mortgage in New Zealand.

BNZ allows you to link up to fifty accounts. Westpac allows ten linked accounts, and Kiwibank allows eight.

This may be useful if you have multiple savings accounts that you want to use to offset your mortgage balance.

For example, if you use multiple accounts to budget, you can link them to your offset mortgage.

In my case, my and the husband’s splurge money accounts, our children’s pocket money accounts, our grocery account, travel savings, bills account and cash savings accounts (emergency fund etc.) all offset against the mortgage for one of our rental properties (we’ve already paid off our own home).

A revolving credit loan and an offset mortgage sound the same. What’s the difference?

While revolving credit loans and offset mortgages share some similarities, there are also some crucial differences.

Here are the key differences between the two:

Structure: Revolving credit loans are structured like a line of credit, where the borrower can draw on the loan up to a specific limit and make payments as they see fit.

The rate is typically a variable interest rate and is based on the outstanding balance.

In contrast, offset mortgages are structured like a traditional mortgage, with regular payments made towards both the principal and interest.

Savings offset: One key feature of an offset mortgage is the ability to offset savings against the outstanding loan balance, reducing the amount of interest paid.

This means that interest is only charged on the net balance, after deducting any savings held in a linked savings account. Revolving credit loans do not typically offer this feature.

Access to funds: With a revolving credit loan, the borrower has ongoing access to the funds, which can be withdrawn and repaid as needed.

In contrast, an offset mortgage account typically does not allow for ongoing withdrawals, as the savings used to offset the loan balance must be maintained in a linked savings account.

Do I have access to my savings if I have an offset mortgage?

Yes, with an offset mortgage, you generally have access to your savings as they are held in a linked savings account that is offset against your mortgage balance.

While the savings are used to offset the interest charged on your mortgage, they are still considered your own funds and can be accessed as needed.

However, remember withdrawing funds from your linked savings account may reduce the amount of offset against your mortgage balance and increase the amount of interest charged on your mortgage.

So, if you do need to withdraw funds, it’s a good idea to speak with your lender or mortgage advisor first to understand the impact on your mortgage and to explore any alternatives that may be available.

Can you make lump sum repayments with an offset mortgage?

Yes, in most cases, you can make lump sum repayments on an offset mortgage.

The availability and terms of making lump sum payments may vary depending on the lender and the specific offset mortgage product.

Typically, New Zealand offset mortgages allow borrowers to make additional payments towards their mortgage balance as they are mostly a floating home loan option, which tends to allow extra repayments without penalty.

Some lenders may have specific rules or limitations around lump sum payments, such as minimum and maximum amounts or frequency of payments.

Can I get an offset mortgage for an investment property?

Yes, it is possible to get an offset mortgage for an investment property in New Zealand.

While offset mortgages are most commonly associated with owner-occupied properties, some lenders do offer offset mortgages for investment properties as well.

However, it’s worth noting that the availability and terms of offset mortgages for investment properties may be different from those for owner-occupied properties.

For example, some lenders may require a higher deposit or equity threshold for investment properties or may charge higher interest rates or fees.

Shop around and compare different lenders and mortgage products to find the one that best meets your needs.

Mortgage brokers will be able to do much of the hard work for you, so definitely seek out one near you.

Speak with an accountant or financial adviser to understand how an offset mortgage on an investment property may impact your tax situation.

How We Use an Offset Mortgage

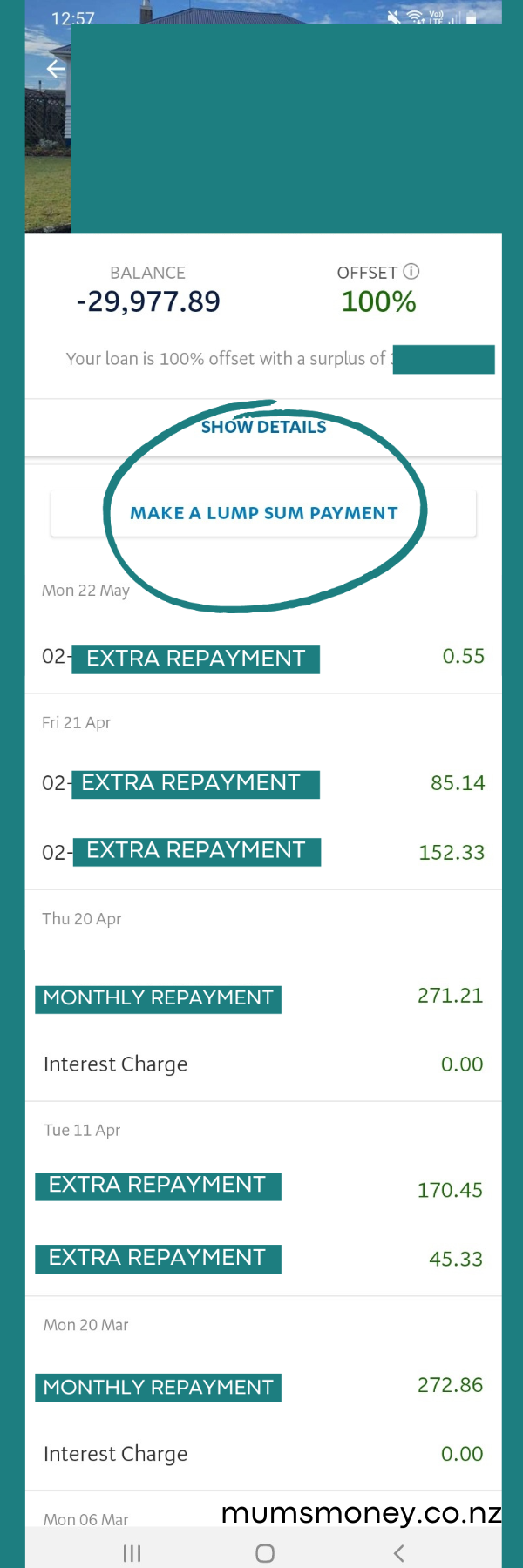

I’m adding a quick case study of how we use an offset home loan for reference. The screenshots below are my own.

Before I start, I want to clarify two things:

- We currently use an offset account on an investment property home loan.

- We used the EXACT same strategy on our OWN home to pay that mortgage off in five years.

We’ve been using an offset mortgage (BNZ Total Money) for as long as the option has been available.

I’ve always been very interested in making every dollar work as hard as it possibly could for us.

When we came back to live in New Zealand, that became even more vital as our earning power reduced.

We structured our home loan with a fixed portion and a floating (offset) portion.

We’ve never had a complete home loan as an offset, as we’ve never held that much cash in savings.

For example, this might mean having $200,000 across various fixed rates and $30,000 on offset.

We estimate how much cash savings we can hold during a year and maintain an offset balance around that amount – currently just under $30,000.

Our goal is to pay no interest at all. We do that by offsetting 100% of the loan with our savings.

This means that the entire monthly payment goes to the principal – reducing the loan balance.

Being a floating loan means we can and do make extra lump sum repayments as frequently as we can with no penalty.

Even when the extra repayment is $0.55! Every little bit helps!

When we eventually pay this loan off totally, we will switch a portion of another loan to offset so we always have an offset facility to avail of until we are completely debt free.

So that’s how we use an offset account to optimise our finances for maximum debt reduction.

Do you use an offset account? Do you have any tips to add?